Panera Bread 2013 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2013 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44

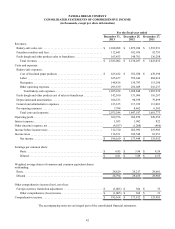

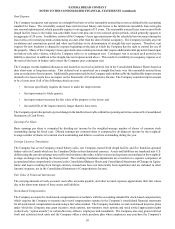

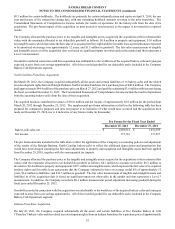

PANERA BREAD COMPANY

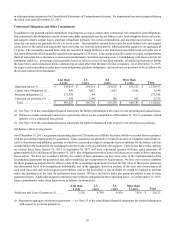

CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY

(in thousands)

Common Stock

Additional

Paid-in

Capital

Retained

Earnings

Accumulated

Other

Comprehensive

Income (Loss)

Class A Class B Treasury Stock

Shares Amount Shares Amount Shares Amount Total

Balance, December 28, 2010. . . . . . 29,007 $ 3 1,392 $ — 1,119 $ (78,990) $ 130,005 $ 544,315 $ 275 $ 595,608

Comprehensive income:

Net income. . . . . . . . . . . . . . . . . . . — — — — — — — 135,952 — 135,952

Other comprehensive income . . . . — — — — — — — — 33 33

Comprehensive income . . . . . . 135,985

Issuance of common stock . . . . . . . . 21 — — — — — 2,040 — — 2,040

Issuance of restricted stock (net of

forfeitures). . . . . . . . . . . . . . . . . . . . . 93 —— —— — — — — —

Exercise of employee stock options . 65 — — — — — 3,193 — — 3,193

Stock-based compensation expense . — — — — — — 9,861 — — 9,861

Conversion of Class B to Class A. . . 8 — (8) — — — — — — —

Exercise of SSARs . . . . . . . . . . . . . . 1 — — — — — — — — —

Repurchase of common stock . . . . . . (929) — — — 929 (96,605) — — — (96,605)

Tax benefit from exercise of stock

options. . . . . . . . . . . . . . . . . . . . . . . . — — — — — — 4,994 — — 4,994

Balance, December 27, 2011. . . . . . 28,266 $ 3 1,384 $ — 2,048 $ (175,595) $ 150,093 $ 680,267 $ 308 $ 655,076

Comprehensive income:

Net income. . . . . . . . . . . . . . . . . . . — — — — — — — 173,448 — 173,448

Other comprehensive income . . . . — — — — — — — — 364 364

Comprehensive income . . . . . . 173,812

Issuance of common stock . . . . . . . . 20 — — — — — 2,462 — — 2,462

Issuance of restricted stock (net of

forfeitures). . . . . . . . . . . . . . . . . . . . . 28 —— —— — — — — —

Exercise of employee stock options . 96 — — — — — 4,455 — — 4,455

Stock-based compensation expense . — — — — — — 9,094 — — 9,094

Exercise of SSARs . . . . . . . . . . . . . . 1 — — — — — (1) — — (1)

Repurchase of common stock . . . . . . (202) — — — 202 (31,566) — — — (31,566)

Tax benefit from exercise of stock

options. . . . . . . . . . . . . . . . . . . . . . . . — — — — — — 8,587 — — 8,587

Balance, December 25, 2012. . . . . . 28,209 $ 3 1,384 $ — 2,250 $ (207,161) $ 174,690 $ 853,715 $ 672 $ 821,919

Comprehensive income:

Net income. . . . . . . . . . . . . . . . . . . — — — — — — — 196,169 — 196,169

Other comprehensive income . . . . — — — — — — — — (1,005) (1,005)

Comprehensive income . . . . . . 195,164

Issuance of common stock . . . . . . . . 20 — — — — — 2,841 — — 2,841

Issuance of restricted stock (net of

forfeitures). . . . . . . . . . . . . . . . . . . . . 78 —— —— — — — — —

Exercise of employee stock options . 12 — — — — — 575 — — 575

Stock-based compensation expense . — — — — — — 10,703 — — 10,703

Conversion of Class B to Class A. . . 2 — (2) — — — — — — —

Exercise of SSARs . . . . . . . . . . . . . . 2 — — — — — (1) — — (1)

Repurchase of common stock . . . . . . (2,033) — — — 2,033 (339,409) — — — (339,409)

Tax benefit from exercise of stock

options. . . . . . . . . . . . . . . . . . . . . . . . — — — — — — 8,100 — — 8,100

Balance, December 31, 2013. . . . . . 26,290 $ 3 1,382 $ — 4,283 $ (546,570) $ 196,908 $1,049,884 $ (333) $ 699,892

The accompanying notes are an integral part of the consolidated financial statements.