Panera Bread 2013 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2013 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PANERA BREAD COMPANY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (continued)

59

Legal Proceedings

From time to time, the Company is subject to various legal proceedings, claims, and litigation that arise in the ordinary course of

its business. As of the date of this Annual Report on Form 10-K, the Company is not a party to any litigation, the outcome of

which, if determined adversely to the Company, would individually or in the aggregate be reasonably expected to have a material

adverse effect on the Company's results of operations, cash flows, financial position or brand.

Other

The Company is subject to on-going federal and state income tax audits and sales and use tax audits. The Company does not

believe the ultimate resolution of these actions will have a material adverse effect on its consolidated financial statements. However,

a significant increase in the number of these audits, or one or more audits under which the Company incurs greater liabilities than

is currently anticipated, could materially and adversely affect its consolidated financial statements. The Company believes reserves

for these matters are adequately provided for in its consolidated financial statements.

14. Income Taxes

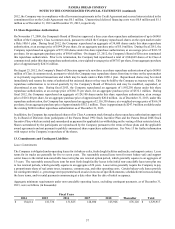

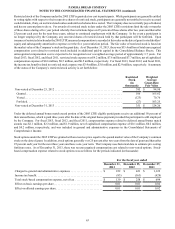

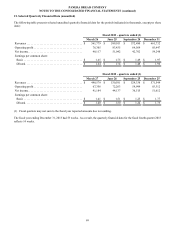

The components of income (loss) before income taxes, by tax jurisdiction, were as follows for the periods indicated (in thousands):

For the fiscal year ended

December 31,

2013

December 25,

2012

December 27,

2011

United States . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 317,479 $ 286,702 $ 221,906

Canada. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (4,759)(3,706)(2,003)

Income before income taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 312,720 $ 282,996 $ 219,903

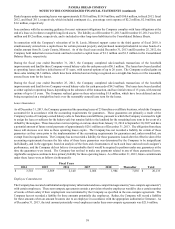

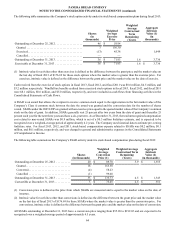

The provision for income taxes consisted of the following for the periods indicated (in thousands):

For the fiscal year ended

December 31,

2013

December 25,

2012

December 27,

2011

Current:

U.S. federal . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 87,548 $ 72,434 $ 67,466

U.S. state and local . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18,638 15,955 15,705

Foreign . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — — (571)

106,186 88,389 82,600

Deferred:

U.S. federal . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8,547 16,640 1,084

U.S. state and local . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,804 3,603 267

Foreign . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14 916 —

10,365 21,159 1,351

Total provision for income taxes. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 116,551 $ 109,548 $ 83,951

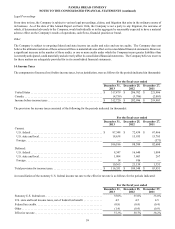

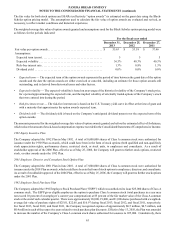

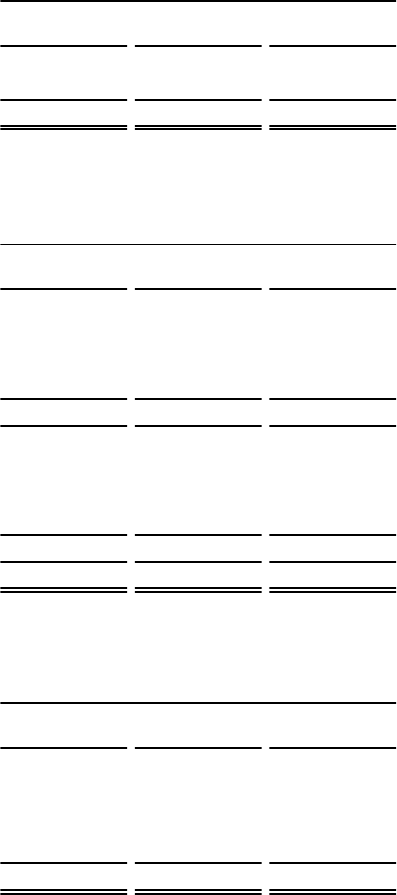

A reconciliation of the statutory U.S. federal income tax rate to the effective tax rate is as follows for the periods indicated:

For the fiscal year ended

December 31,

2013

December 25,

2012

December 27,

2011

Statutory U.S. federal rate. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 35.0% 35.0% 35.0%

U.S. state and local income taxes, net of federal tax benefit . . . . . . . . . . . . . 4.5 4.5 4.5

Federal tax credits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (0.8)(0.4)(0.4)

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (1.4)(0.4)(0.9)

Effective tax rate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 37.3% 38.7% 38.2%