Panera Bread 2013 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2013 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.PANERA BREAD COMPANY

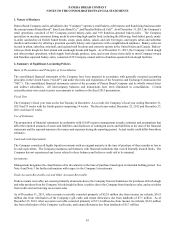

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (continued)

50

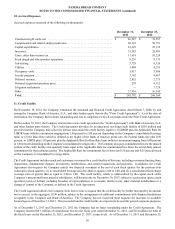

Rent Expense

The Company recognizes rent expense on a straight-line basis over the reasonably assured lease term as defined in the accounting

standard for leases. The reasonably assured lease term for most bakery-cafe leases is the initial non-cancelable lease term plus

one renewal option period, which generally equates to an aggregate of 15 years. The reasonably assured lease term on most fresh

dough facility leases is the initial non-cancelable lease term plus one to two renewal option periods, which generally equates to

an aggregate of 20 years. In addition, certain of the Company’s lease agreements provide for scheduled rent increases during the

lease terms or for rental payments commencing at a date other than the date of initial occupancy. The Company includes any rent

escalations and construction period and other rent holidays in its determination of straight-line rent expense. Therefore, rent

expense for new locations is charged to expense beginning on the date at which the Company has the right to control the use of

the property. Many of the Company's lease agreements also contain provisions that require additional rental payments based upon

net bakery-cafe sales volume, which the Company refers to as contingent rent. Contingent rent is accrued each period as the

liability is incurred, in addition to the straight-line rent expense noted above. This results in variability in occupancy expense over

the term of the lease in bakery-cafes where the Company pays contingent rent.

The Company records landlord allowances and incentives received as deferred rent in the Consolidated Balance Sheets based on

their short-term or long-term nature. This deferred rent is amortized on a straight-line basis over the reasonably assured lease

term as a reduction of rent expense. Additionally, payments made by the Company and reimbursed by the landlord for improvements

deemed to be lessor assets have no impact on the Statements of Comprehensive Income. The Company considers improvements

to be a lessor asset if all of the following criteria are met:

• the lease specifically requires the lessee to make the improvement;

• the improvement is fairly generic;

• the improvement increases the fair value of the property to the lessor; and

• the useful life of the improvement is longer than the lease term.

The Company reports the period to period change in the landlord receivable within the operating activities section of its Consolidated

Statements of Cash Flows.

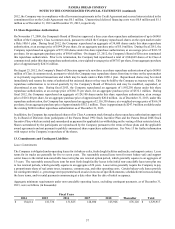

Earnings Per Share

Basic earnings per share is computed by dividing net income by the weighted-average number of shares of common stock

outstanding during the fiscal year. Diluted earnings per common share is computed by dividing net income by the weighted-

average number of shares of common stock outstanding and dilutive securities outstanding during the year.

Foreign Currency Translation

The Company has seven Company-owned bakery-cafes, one Company-owned fresh dough facility, and five franchise-operated

bakery-cafes in Canada which use the Canadian Dollar as their functional currency. Assets and liabilities are translated into U.S.

dollars using the current exchange rate in effect at the balance sheet date, while revenues and expenses are translated at the weighted-

average exchange rate during the fiscal period. The resulting translation adjustments are recorded as a separate component of

accumulated other comprehensive income in the Consolidated Balance Sheets and Consolidated Statements of Changes in Equity.

Gains and losses resulting from foreign currency transactions have not historically been significant and are included in other

(income) expense, net in the Consolidated Statements of Comprehensive Income.

Fair Value of Financial Instruments

The carrying amounts of cash, accounts receivable, accounts payable, and other accrued expenses approximate their fair values

due to the short-term nature of these assets and liabilities.

Stock-Based Compensation

The Company accounts for stock-based compensation in accordance with the accounting standard for stock-based compensation,

which requires the Company to measure and record compensation expense in the Company’s consolidated financial statements

for all stock-based compensation awards using a fair value method. The Company maintains several stock-based incentive plans

under which the Company may grant incentive stock options, non-statutory stock options and stock settled appreciation rights

(collectively, “option awards”) to certain directors, officers, employees and consultants. The Company also may grant restricted

stock and restricted stock units and the Company offers a stock purchase plan where employees may purchase the Company’s