Panera Bread 2013 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2013 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

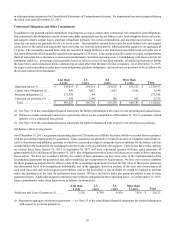

43

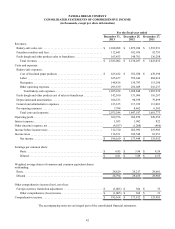

PANERA BREAD COMPANY

CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

For the fiscal year ended

December 31,

2013

December 25,

2012

December 27,

2011

Cash flows from operations:

Net income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 196,169 $ 173,448 $ 135,952

Adjustments to reconcile net income to net cash provided by operating

activities:

Depreciation and amortization. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 106,523 90,939 79,899

Stock-based compensation expense. . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10,703 9,094 9,861

Tax benefit from exercise of stock options . . . . . . . . . . . . . . . . . . . . . . . (8,100)(8,587)(4,994)

Deferred income taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10,356 20,334 1,351

Loss on disposals of property and equipment . . . . . . . . . . . . . . . . . . . . . 5,764 3,995 1,789

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 589 475 634

Changes in operating assets and liabilities, excluding the effect of

acquisitions and dispositions:

Trade and other accounts receivable, net. . . . . . . . . . . . . . . . . . . . . . . . . 3,021 (31,414)(16,369)

Inventories . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (2,186)(2,440)(2,183)

Prepaid expenses and other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (841)(10,995)(7,323)

Deposits and other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,449 161 117

Accounts payable. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8,162 (6,513) 8,538

Accrued expenses. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13,372 49,246 19,630

Deferred rent . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5,868 5,718 6,081

Other long-term liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (2,432)(4,005) 3,906

Net cash provided by operating activities . . . . . . . . . . . . . . . . . . . . . . 348,417 289,456 236,889

Cash flows from investing activities:

Additions to property and equipment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (192,010)(152,328)(107,932)

Acquisitions, net of cash acquired . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (2,446)(47,951)(44,377)

Purchase of investments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (97,919)— —

Proceeds from sale of investments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 97,936 — —

Proceeds from sale of property and equipment . . . . . . . . . . . . . . . . . . . . . . — — 115

Proceeds from sale-leaseback transactions. . . . . . . . . . . . . . . . . . . . . . . . . . 6,132 4,538 —

Net cash used in investing activities . . . . . . . . . . . . . . . . . . . . . . . . . . (188,307)(195,741)(152,194)

Cash flows from financing activities:

Repurchase of common stock. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (339,409)(31,566)(96,605)

Exercise of employee stock options . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 573 4,455 3,193

Tax benefit from exercise of stock options. . . . . . . . . . . . . . . . . . . . . . . . . . 8,100 8,587 4,994

Proceeds from issuance of common stock under employee benefit plans . . 2,842 2,462 2,040

Capitalized debt issuance costs. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . —(1,097)—

Payment of deferred acquisition holdback . . . . . . . . . . . . . . . . . . . . . . . . . . (4,112)(2,055)(4,976)

Net cash used in financing activities. . . . . . . . . . . . . . . . . . . . . . . . . . (332,006)(19,214)(91,354)

Net (decrease) increase in cash and cash equivalents . . . . . . . . . . . . . . . . . . . (171,896) 74,501 (6,659)

Cash and cash equivalents at beginning of period . . . . . . . . . . . . . . . . . . . . . 297,141 222,640 229,299

Cash and cash equivalents at end of period . . . . . . . . . . . . . . . . . . . . . . . . . . $ 125,245 $ 297,141 $ 222,640

The accompanying notes are an integral part of the consolidated financial statements.