Panera Bread 2013 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2013 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

37

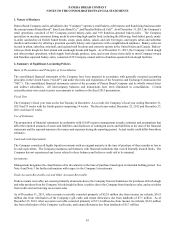

Employee Commitments

We have confidential and proprietary information and non-competition agreements, referred to as non-compete agreements, with

certain employees. These non-compete agreements contain a provision whereby employees would be due a certain number of

weeks of their salary if their employment was terminated by us as specified in the non-compete agreement. We have not recorded

a liability for these amounts potentially due to employees. Rather, we will record a liability for these amounts when an amount

becomes due to an employee in accordance with the appropriate authoritative literature. As of December 31, 2013, the total amount

potentially owed employees under these non-compete agreements was $21.6 million.

Impact of Inflation

Our profitability depends in part on our ability to anticipate and react to changes in food, supply, labor, occupancy, and other costs.

In the past, we have been able to recover a significant portion of inflationary costs and commodity price increases, including price

increases in fuel, proteins, dairy, wheat, tuna, and cream cheese among others, through increased menu prices. There have been,

and there may be in the future, delays in implementing such menu price increases, and competitive pressures may limit our ability

to recover such cost increases in their entirety. Historically, the effects of inflation on our consolidated results of operations have

not been materially adverse. However, inherent volatility experienced in certain commodity markets, such as those for wheat,

proteins, including chicken raised without antibiotics, and fuel may have an adverse effect on us in the future. The extent of the

impact will depend on our ability and timing to increase food prices.

A majority of our associates are paid hourly rates regulated by federal and state minimum wage laws. Although we have and will

continue to attempt to pass along any increased labor costs through food price increases, there can be no assurance that all such

increased labor costs can be reflected in our prices or that increased prices will be absorbed by consumers without diminishing to

some degree consumer spending at the bakery-cafes.

Recent Accounting Pronouncements

In July 2013, the Financial Accounting Standards Board issued Accounting Standards Update No. 2013-11, “Income Taxes (Topic

740): Presentation of an Unrecognized Tax Benefit When a Net Operating Loss Carryforward, a Similar Tax Loss, or a Tax Credit

Carryforward Exists”. This guidance requires an unrecognized tax benefit related to a net operating loss carryforward, a similar

tax loss or a tax credit carryforward to be presented as a reduction to a deferred tax asset, unless the tax benefit is not available at

the reporting date to settle any additional income taxes under the tax law of the applicable tax jurisdiction. The guidance is effective

for fiscal years and interim periods beginning after December 15, 2013, with early adoption permitted. The adoption of this

guidance is not expected to have a material effect on our consolidated financial statements.