Panera Bread 2013 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2013 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PANERA BREAD COMPANY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (continued)

58

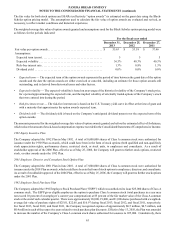

Rental expense under operating leases was approximately $130.0 million, $114.8 million, and $100.6 million, in fiscal 2013, fiscal

2012, and fiscal 2011, respectively, which included contingent (i.e., percentage rent) expense of $2.2 million, $2.0 million, and

$1.6 million, respectively.

In accordance with the accounting guidance for asset retirement obligations the Company complies with lease obligations at the

end of a lease as it relates to tangible long-lived assets. The liability as of December 31, 2013 and December 25, 2012 was $10.2

million and $9.2 million, respectively, and is included in other long-term liabilities in the Consolidated Balance Sheets.

In connection with the Company’s relocation of its St. Louis, Missouri support center in the third quarter of fiscal 2010, it

simultaneously entered into a capital lease for certain personal property and purchased municipal industrial revenue bonds of a

similar amount from St. Louis County, Missouri. As of the fiscal years ended December 31, 2013 and December 25, 2012, the

Company held industrial revenue bonds and had recorded a capital lease of $1.3 million and $1.5 million in the Consolidated

Balance Sheets, respectively.

During the fiscal year ended December 31, 2013, the Company completed sale-leaseback transactions of the leasehold

improvements and land for three Company-owned bakery-cafes for cash proceeds of $6.1 million. The leases have been classified

as operating leases and have initial terms of 15 years, with renewal options of up to 20 years. The Company realized gains on

these sales totaling $0.3 million, which have been deferred and are being recognized on a straight-line basis over the reasonably

assured lease term for the leases.

During the fiscal year ended December 25, 2012, the Company completed sale-leaseback transactions of the leasehold

improvements and land for two Company-owned bakery-cafes for cash proceeds of $4.5 million. The leases have been classified

as either capital or operating leases, depending on the substance of the transaction, and have initial terms of 15 years, with renewal

options of up to 15 years. The Company realized gains on these sales totaling $1.0 million, which have been deferred and are

being recognized on a straight-line basis over the reasonably assured lease term for the leases.

Lease Guarantees

As of December 31, 2013, the Company guaranteed the operating leases of 25 franchisee or affiliate locations, which the Company

accounted for in accordance with the accounting requirements for guarantees. These guarantees are primarily a result of the

Company's sales of Company-owned bakery-cafes to franchisees and affiliates, pursuant to which the Company exercised its right

to assign the lease or sublease for the bakery-cafe but remains liable to the landlord for the remaining lease term in the event of a

default by the assignee. These leases have terms expiring on various dates from January 31, 2014 to September 30, 2027 and have

a potential amount of future rental payments of approximately $20.1 million as of December 31, 2013. The obligation from these

leases will decrease over time as these operating leases expire. The Company has not recorded a liability for certain of these

guarantees as they arose prior to the implementation of the accounting requirements for guarantees and, unless modified, are

exempt from its requirements. The Company has not recorded a liability for those guarantees issued after the effective date of the

accounting requirements because the fair value of these lease guarantees was determined by the Company to be insignificant

individually, and in the aggregate, based on analysis of the facts and circumstances of each such lease and each such assignee’s

performance, and the Company did not believe it was probable that it would be required to perform under any guarantees at the

time the guarantees were issued. The Company has not had to make any payments related to any of these guaranteed leases.

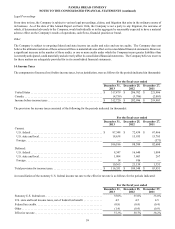

Applicable assignees continue to have primary liability for these operating leases. As of December 31, 2013, future commitments

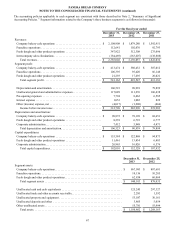

under these leases were as follows (in thousands):

Fiscal Years

2014 2015 2016 2017 2018 Thereafter Total

$ 3,518 2,569 2,140 2,066 1,984 7,856 $ 20,133

Employee Commitments

The Company has executed confidential and proprietary information and non-competition agreements (“non-compete agreements”)

with certain employees. These non-compete agreements contain a provision whereby employees would be due a certain number

of weeks of their salary if their employment was terminated by the Company as specified in the non-compete agreement. The

Company has not recorded a liability for these amounts potentially due employees. Rather, the Company will record a liability

for these amounts when an amount becomes due to an employee in accordance with the appropriate authoritative literature. As

of December 31, 2013, the total amount potentially owed employees under these non-compete agreements was $21.6 million.