Panera Bread 2013 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2013 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PANERA BREAD COMPANY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (continued)

55

The Company recorded depreciation expense related to these assets of $97.2 million, $82.7 million, and $74.2 million for the

fiscal years ended December 31, 2013, December 25, 2012, and December 27, 2011, respectively.

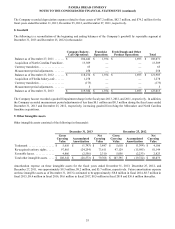

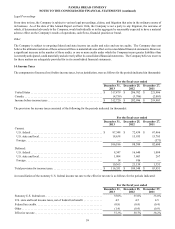

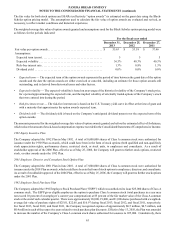

8. Goodwill

The following is a reconciliation of the beginning and ending balances of the Company’s goodwill by reportable segment at

December 31, 2013 and December 25, 2012 (in thousands):

Company Bakery-

Cafe Operations

Franchise

Operations

Fresh Dough and Other

Product Operations Total

Balance as of December 27, 2011 . . . . . . . $ 104,442 $ 1,934 $ 1,695 $ 108,071

Acquisition of North Carolina Franchisee . 13,509 — — 13,509

Currency translation . . . . . . . . . . . . . . . . . . 65 — — 65

Measurement period adjustments . . . . . . . . 258 — — 258

Balance as of December 25, 2012 . . . . . . . $ 118,274 $ 1,934 $ 1,695 $ 121,903

Acquisition of Florida bakery-cafe. . . . . . . 1,278 — — 1,278

Currency translation . . . . . . . . . . . . . . . . . . (173)— —

(173)

Measurement period adjustments . . . . . . . . 5 — — 5

Balance as of December 31, 2013 $ 119,384 $ 1,934 $ 1,695 $ 123,013

The Company has not recorded a goodwill impairment charge in the fiscal years 2013, 2012, and 2011, respectively. In addition,

the Company recorded measurement period adjustments of less than $0.1 million and $0.3 million during the fiscal years ended

December 31, 2013 and December 25, 2012, respectively, increasing goodwill involving the Milwaukee and North Carolina

franchise acquisitions.

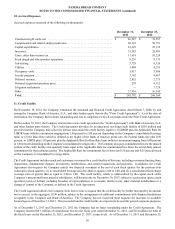

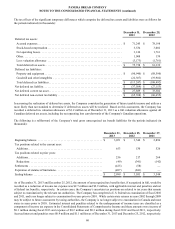

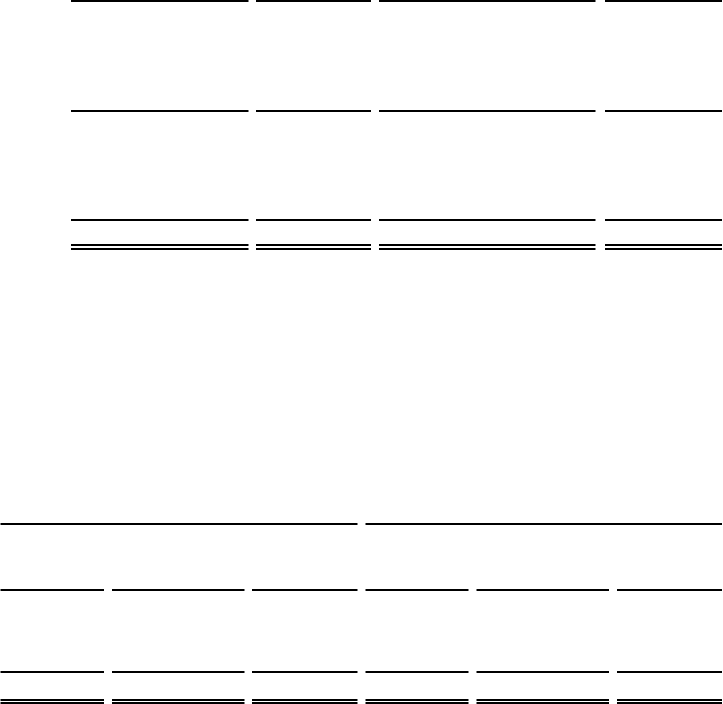

9. Other Intangible Assets

Other intangible assets consisted of the following (in thousands):

December 31, 2013 December 25, 2012

Gross

Carrying

Val ue

Accumulated

Amortization

Net

Carrying

Val ue

Gross

Carrying

Val ue

Accumulated

Amortization

Net

Carrying

Val ue

Trademark . . . . . . . . . . . . . . . . . . $ 5,610 $ (1,763) $ 3,847 $ 5,610 $ (1,504) $ 4,106

Re-acquired territory rights . . . . . 97,865 (24,254) 73,611 97,129 (15,985) 81,144

Favorable leases . . . . . . . . . . . . . . 4,866 (2,556) 2,310 5,056 (2,233) 2,823

Total other intangible assets. . . . . $ 108,341 $ (28,573) $ 79,768 $ 107,795 $ (19,722) $ 88,073

Amortization expense on these intangible assets for the fiscal years ended December 31, 2013, December 25, 2012, and

December 27, 2011, was approximately $9.3 million, $8.2 million, and $5.7 million, respectively. Future amortization expense

on these intangible assets as of December 31, 2013 is estimated to be approximately: $8.8 million in fiscal 2014, $8.7 million in

fiscal 2015, $8.6 million in fiscal 2016, $8.6 million in fiscal 2017, $8.5 million in fiscal 2018 and $36.6 million thereafter.