Panera Bread 2013 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2013 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

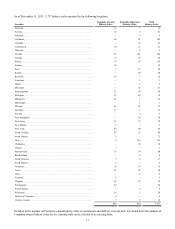

27

Development Agreements, or ADAs, with franchisees, which provide for the majority of these bakery-cafes to open in the next

four to five years. An ADA requires a franchisee to develop a specified number of bakery-cafes by specified dates. If a franchisee

fails to develop bakery-cafes on the schedule set forth in the ADA, we have the right to terminate the ADA and develop Company-

owned locations or develop locations through new franchisees in that market. We may exercise one or more alternative remedies

to address defaults by franchisees, including not only development defaults, but also defaults in complying with our operating and

brand standards and other covenants included in the ADAs and franchise agreements. We may waive compliance with certain

requirements under its ADAs and franchise agreements if we determine that such action is warranted under the particular

circumstances.

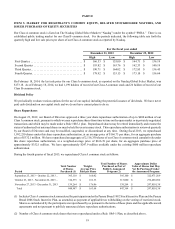

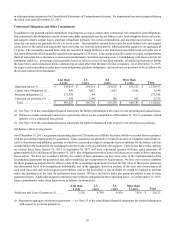

Fresh dough and other product sales to franchisees

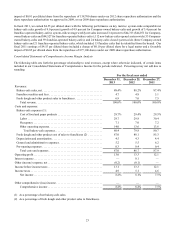

The following table summarizes fresh dough and other product sales to franchisees for the periods indicated (dollars in thousands):

For the fiscal year ended

December 31,

2013

December 25,

2012

December 27,

2011

% Change

in 2013

% Change

in 2012

Fresh dough and other product sales to

franchisees. . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 163,453 $ 148,701 $ 136,288 9.9% 9.1%

The increase in fresh dough and other product sales to franchisees in fiscal 2013 compared to the prior fiscal year was primarily

due to the impact of the additional week in fiscal 2013, which contributed fresh dough and other product sales to franchisees of

approximately $2.8 million, the 2.0 percent increase in franchise-operated comparable net bakery-cafe sales, which reflects a

comparative 53 week period in fiscal 2012, and the opening of 70 franchise-operated cafes.

The increase in fresh dough and other product sales to franchisees in fiscal 2012 was primarily due to the 5.0 percent increase in

franchise-operated comparable net bakery-cafe sales, the opening of 64 franchise-operated cafes, and an increase in sales of fresh

produce to franchisees, partially offset by our purchase of 16 franchise-operated bakery-cafes and the closure of six franchise-

operated bakery-cafes.

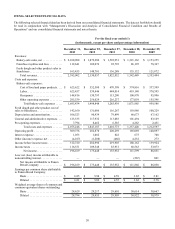

Costs and Expenses

The cost of food and paper products includes the costs associated with the fresh dough and other product operations that sell fresh

dough and other products to Company-owned bakery-cafes, as well as the cost of food and paper products supplied by third-party

vendors and distributors. The costs associated with the fresh dough and other product operations that sell fresh dough and other

products to the franchise-operated bakery-cafes are excluded from the cost of food and paper products and are shown separately

as fresh dough and other product cost of sales to franchisees in the Consolidated Statements of Comprehensive Income.

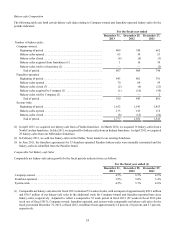

The following table summarizes cost of food and paper products for the periods indicated (dollars in thousands):

For the fiscal year ended

December 31,

2013

December 25,

2012

December 27,

2011

% Change

in 2013

% Change

in 2012

Cost of food and paper products . . . . . . . . . . . $ 625,622 $ 552,580 $ 470,398 13.2% 17.5%

As a percent of bakery-cafe sales, net. . . . . . . 29.7% 29.4% 29.5%

The increase in the cost of food and paper products in fiscal 2013 as a percentage of net bakery-cafe sales was primarily due to a

shift in product mix towards higher ingredient cost products, partially offset by improved leverage of our fresh dough manufacturing

costs due to additional bakery-cafe openings. In fiscal 2013, there was an average of 74.2 bakery-cafes per fresh dough facility

compared to an average of 69.2 bakery-cafes in fiscal 2012.

The decrease in the cost of food and paper products in fiscal 2012 as a percentage of net bakery-cafe sales was primarily due to

improved leverage of our fresh dough manufacturing costs due to additional bakery-cafe openings and improved leverage from

higher comparable net bakery-cafe sales. In fiscal 2012, there was an average of 69.2 bakery-cafes per fresh dough facility

compared to an average of 64.2 bakery-cafes in fiscal 2011.