NetFlix 2015 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2015 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

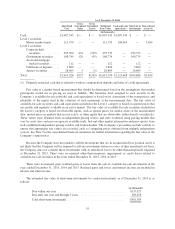

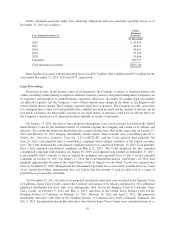

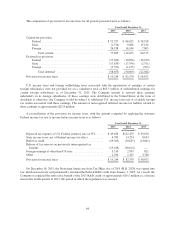

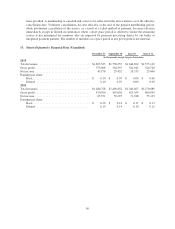

The components of deferred tax assets and liabilities were as follows:

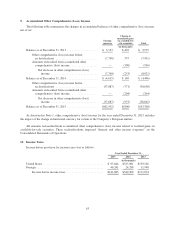

As of December 31,

2015 2014

(in thousands)

Deferred tax assets (liabilities):

Stock-based compensation ............................ $131,339 $100,397

Accruals and reserves ................................ 14,367 13,415

Depreciation and amortization ......................... (43,204) (11,708)

R&D credits ........................................ 74,091 21,014

Other ............................................. 3,980 (2,778)

Total deferred tax assets .................................. $180,573 $120,340

All deferred tax assets are classified as “Other non-current assets” on the Consolidated Balance Sheets as of

December 31, 2015 and December 31, 2014. In evaluating its ability to realize the net deferred tax assets, the

Company considered all available positive and negative evidence, including its past operating results and the

forecast of future market growth, forecasted earnings, future taxable income, and prudent and feasible tax

planning strategies. As of December 31, 2015 and 2014 , it was considered more likely than not that substantially

all deferred tax assets would be realized, and no valuation allowance was recorded.

As of December 31, 2015, the Company’s Federal R&D tax credit and state tax credit carryforwards for tax

return purposes were $44.1 million , and $59.3 million , respectively. The Federal R&D tax credit carryforwards

expire through 2035. State tax credit carryforwards of $58.8 million can be carried forward indefinitely and $0.5

million expire in 2024.

As of December 31, 2015, the Company’s net operating loss carryforwards for Federal and state tax return

purposes were $104.8 million and $237.0 million , respectively, which expire in 2035. These net operating losses

were generated as a result of excess stock option deductions. Pursuant to Accounting Standards Codification 718,

Compensation—Stock Compensation , the Company has not recognized the related $45.0 million tax benefit from

the Federal and state net operating losses attributable to excess stock option deductions in gross deferred tax

assets. The $45.0 million tax benefit will be credited directly to additional paid-in capital when net operating

losses attributable to excess stock option deductions are utilized to reduce taxes payable.

Income tax benefits attributable to the exercise of employee stock options of $79.9 million , $88.9 million

and $80.0 million for the years ended December 31, 2015, 2014 and 2013, respectively, were recorded directly to

additional paid-in-capital.

65