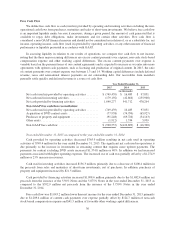

NetFlix 2015 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2015 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

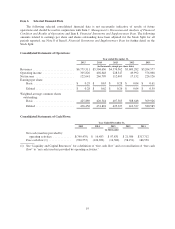

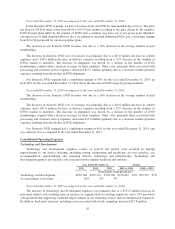

Interest and Other Income (Expense)

Interest and other income (expense) consists primarily of interest earned on cash, cash equivalents and

short-term investments and foreign exchange gains and losses on foreign currency denominated balances.

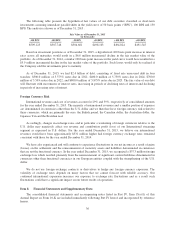

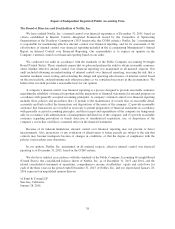

Year Ended December 31, Change

2015 2014 2013 2015 vs. 2014 2014 vs. 2013

(in thousands, except percentages)

Interest and other income

(expense) ................. $(31,225) $(3,060) $(3,002) $(28,165) (920)% $(58) (2)%

Year ended December 31, 2015 as compared to the year ended December 31, 2014

Interest and other income (expense) decreased for the year ended December 31, 2015 as compared to the

prior year due to a $37.3 million foreign exchange loss, incurred primarily in the first quarter of 2015. The

foreign exchange loss was primarily driven by the remeasurement of significant content liabilities denominated

in currencies other than functional currencies in our European entities coupled with the strengthening of the U.S.

dollar.

Year ended December 31, 2014 as compared to the year ended December 31, 2013

Interest and other income (expense) for the year ended December 31, 2014 was relatively flat as compared

to the prior year. Losses on foreign currency denominated balances were $8.2 million and $8.4 million for the

years ended December 31, 2014 and 2013, respectively.

Extinguishment of Debt

In connection with the redemption of the outstanding $200.0 million aggregate principal amount of the

8.50% Notes, we recognized a loss on extinguishment of debt of $25.1 million in the year ended December 31,

2013, which consisted of expenses associated with the redemption, including a $19.4 million premium payment

pursuant to the make-whole provision in the indenture governing the 8.50% Notes. For further detail see Note 5

of Item 8, Financial Statements and Supplementary Data.

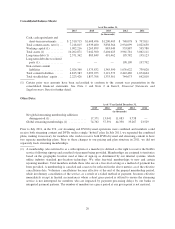

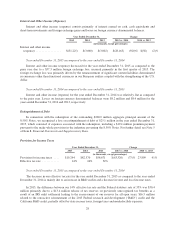

Provision for Income Taxes

Year Ended December 31, Change

2015 2014 2013 2015 vs. 2014 2014 vs. 2013

(in thousands, except percentages)

Provision for income taxes .... $19,244 $82,570 $58,671 $(63,326) (77)% 23,899 41%

Effective tax rate ............ 14% 24% 34%

Year ended December 31, 2015 as compared to the year ended December 31, 2014

The decrease in our effective tax rate for the year ended December 31, 2015 as compared to the year ended

December 31, 2014 is mainly due to an increase in R&D credits and a decrease in state and local income taxes.

In 2015, the difference between our 14% effective tax rate and the Federal statutory rate of 35% was $30.4

million primarily due to a $13.4 million release of tax reserves on previously unrecognized tax benefits as a

result of an IRS audit settlement leading to the reassessment of our reserves for all open years, $16.5 million

related to the retroactive reinstatement of the 2015 Federal research and development (“R&D”) credit and the

California R&D credit; partially offset by state income taxes, foreign taxes and nondeductible expenses.

28