NetFlix 2015 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2015 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.accelerated basis over their estimated useful lives, which range from one year to two years. The Company also

obtains DVD content through revenue sharing agreements with studios and other content providers. Revenue

sharing obligations are expensed as incurred based on shipments.

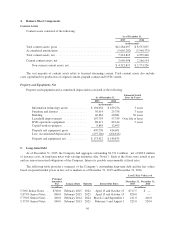

Property and Equipment

Property and equipment are carried at cost less accumulated depreciation. Depreciation is calculated using

the straight-line method over the shorter of the estimated useful lives of the respective assets, generally up to 30

years , or the lease term for leasehold improvements, if applicable. Leased buildings are capitalized and included

in property and equipment when the Company was involved in the construction funding and did not meet the

“sale-leaseback” criteria.

Revenue Recognition

Revenues are recognized ratably over each monthly membership period. Revenues are presented net of the

taxes that are collected from members and remitted to governmental authorities. Deferred revenue consists of

membership fees billed that have not been recognized and gift and other prepaid memberships that have not been

redeemed.

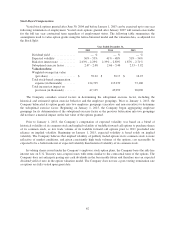

Marketing

Marketing expenses consist primarily of advertising expenses and also include payments made to the

Company’s affiliates and consumer electronics partners. Advertising expenses include promotional activities

such as digital and television advertising. Advertising costs are expensed as incurred. Advertising expenses were

$714.3 million, $533.1 million and $404.0 million for the years ended December 31, 2015, 2014 and 2013,

respectively.

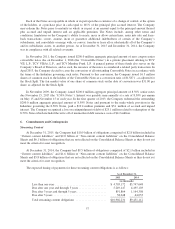

Income Taxes

The Company records a provision for income taxes for the anticipated tax consequences of the reported

results of operations using the asset and liability method. Deferred income taxes are recognized by applying

enacted statutory tax rates applicable to future years to differences between the financial statement carrying

amounts of existing assets and liabilities and their respective tax bases as well as net operating loss and tax credit

carryforwards. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in

the period that includes the enactment date. The measurement of deferred tax assets is reduced, if necessary, by a

valuation allowance for any tax benefits for which future realization is uncertain.

The Company did not recognize certain tax benefits from uncertain tax positions within the provision for

income taxes. The Company may recognize a tax benefit only if it is more likely than not the tax position will be

sustained on examination by the taxing authorities, based on the technical merits of the position. The tax benefits

recognized in the financial statements from such positions are then measured based on the largest benefit that has

a greater than 50% likelihood of being realized upon settlement. The Company recognizes interest and penalties

related to uncertain tax positions in income tax expense. See Note 10 to the consolidated financial statements for

further information regarding income taxes.

Foreign Currency

The functional currency for the Company’s subsidiaries is determined based on the primary economic

environment in which the subsidiary operates. The Company translates the assets and liabilities of its non-U.S.

dollar functional currency subsidiaries into U.S. dollars using exchange rates in effect at the end of each period.

Revenues and expenses for these subsidiaries are translated using rates that approximate those in effect during

the period. Gains and losses from these translations are recognized in cumulative translation adjustment included

in “Accumulated other comprehensive loss” in Stockholders’ equity on the Consolidated Balance Sheets.

52