NetFlix 2015 Annual Report Download - page 27

Download and view the complete annual report

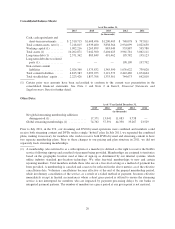

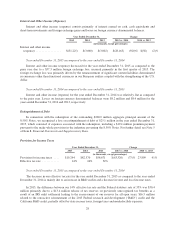

Please find page 27 of the 2015 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Year ended December 31, 2015 as compared to the year ended December 31, 2014

In the Domestic streaming segment, we derive revenues from monthly membership fees for services

consisting solely of streaming content to our members in the United States. Our two screen high definition plan

continues to be the most popular plan choice for new memberships. The increase in our domestic streaming

revenues was due to a 17% growth in the average number of paid memberships and a 4% increase in average

monthly revenue per paying membership resulting from our price changes and plan mix.

The increase in domestic streaming cost of revenues was primarily due to a $208.1 million increase in

content expenses relating to our existing and new streaming content, including more exclusive and original

programming. In addition, we had a $37.9 million increase in streaming delivery expenses and a $39.4 million

increase in other costs, such as payment processing fees and customer service call centers, due to our growing

member base.

Domestic marketing expenses increased primarily due to an increase in advertising and public relations

spending.

Our Domestic streaming segment had a contribution margin of 33% for the year ended December 31, 2015,

which increased as compared to the contribution margin of 27% for the year ended December 31, 2014 due to

growth in paid memberships and revenue, which continued to outpace content and marketing spending. Our 2020

domestic streaming contribution margin target remains at 40%.

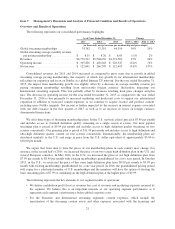

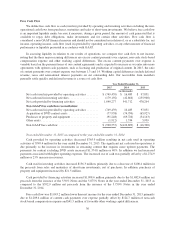

Year ended December 31, 2014 as compared to the year ended December 31, 2013

The increase in our domestic streaming revenues was due to the 22% growth in the average number of paid

memberships, as well as to the 2% increase in average monthly revenue per paying membership resulting from

our price increase for new members in the second quarter of 2014 and introduction of the higher priced plan in

2013.

The increase in domestic streaming cost of revenues was primarily due to the $242.3 million increase in

content expenses relating to our existing and new streaming content, including more exclusive and original

programming. In addition, streaming delivery expenses increased by $59.5 million and other costs, such as

payment processing fees and customer service call centers, increased $36.6 million due to our growing member

base.

Domestic marketing expenses increased primarily due to an increase in advertising and public relations

spending.

Our Domestic streaming segment had a contribution margin of 27% for the year ended December 31, 2014,

which increased as compared to the contribution margin of 23% for the year ended December 31, 2013 due to

growth in paid memberships and revenue, which continued to outpace content and marketing spending.

23