NetFlix 2015 Annual Report Download - page 33

Download and view the complete annual report

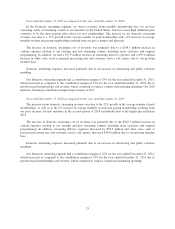

Please find page 33 of the 2015 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.On December 18, 2015, the Protecting Americans from Tax Hikes Act of 2015 (H.R. 2029) was signed into

law which retroactively and permanently extended the Federal R&D credit from January 1, 2015. As a result, we

recognized the retroactive benefit of the 2015 R&D credit as a discrete item in the fourth quarter of 2015, the

period in which the legislation was enacted.

Year ended December 31, 2014 as compared to the year ended December 31, 2013

The decrease in our effective tax rate for the year ended December 31, 2014 as compared to the year ended

December 31, 2013 was primarily attributable to the $38.6 million release of tax reserves on previously

unrecognized tax benefits.

In 2014, the difference between our 24% effective tax rate and the federal statutory rate of 35% was $39.7

million primarily due to a $38.6 million release of tax reserves on previously unrecognized tax benefits as a

result of an IRS Appeals settlement for the tax years 2008-2009 leading to the reassessment of our reserves for

all open years, $10.7 million related to the retroactive reinstatement of the 2014 Federal R&D credit and the

California R&D credit; partially offset by state income taxes, foreign taxes and nondeductible expenses.

On December 19, 2014, the Tax Increase Prevention Act of 2014 (H.R. 5771) was signed into law which

retroactively extended the Federal R&D credit from January 1, 2014 through December 31, 2014. As a result, we

recognized the retroactive benefit of the 2014 Federal R&D credit as a discrete item in the fourth quarter of 2014,

the period in which the legislation was enacted.

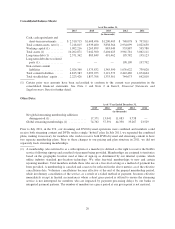

Liquidity and Capital Resources

Cash, cash equivalents and short-term investments increased $702.2 million to $2,310.7 million from

$1,608.5 million as of December 31, 2015 and 2014, respectively. In February 2015, we issued $1,500.0 million

of long-term debt and in February 2014 we issued $400.0 million of long-term debt. The increases in cash in the

year ended December 31, 2015 associated with the issuance of debt was partially offset by cash outflows from

operations and investing activities. Long-term debt, net of debt issuance costs, was $2,371.4 million and $885.8

million as of December 31, 2015 and December 31, 2014, respectively. See Note 5 of Item 8, Financial

Statements and Supplementary Data for additional information.

Our primary uses of cash include the acquisition, licensing and production of content, streaming delivery,

marketing programs and payroll. Investments in original content and in particular content that we produce and

own, require more cash upfront relative to licensed content. We expect to significantly increase our investments

in global streaming content, particularly in original content, which could impact our liquidity and result in future

negative free cash flows.

Although we currently anticipate that cash flows from operations, together with our available funds, will

continue to be sufficient to meet our cash needs for at least the next twelve months, to fund our continued content

investments, we are likely to raise additional capital in future periods. Our ability to obtain this, or any additional

financing that we may choose to, or need to, obtain to finance our international expansion, or investment in

original content or otherwise, will depend on, among other things, our development efforts, business plans,

operating performance and the condition of the capital markets at the time we seek financing. We may not be

able to obtain such financing on terms acceptable to us or at all. If we raise additional funds through the issuance

of equity or debt securities, those securities may have rights, preferences or privileges senior to the rights of our

common stock, and our stockholders may experience dilution.

As of December 31, 2015, $200.3 million of cash and cash equivalents were held by our foreign

subsidiaries. If these funds are needed for our operations in the U.S., we would be required to accrue and pay

U.S. income taxes and foreign withholding taxes on the amount associated with undistributed earnings for certain

foreign subsidiaries. As of December 31, 2015, the amount associated with undistributed earnings for certain

foreign subsidiaries for which we could be required to accrue and pay taxes is $65.3 million. See Note 10 of

Item 8, Financial Statements and Supplementary Data for additional information.

29