NetFlix 2015 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2015 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

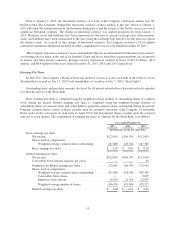

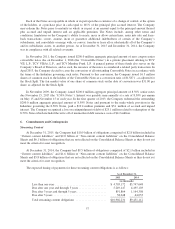

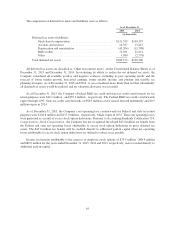

On June 23, 2015, the Company’s Board of Directors declared a seven -for-one stock split in the form of a

stock dividend that was paid on July 14, 2015 to all shareholders of record as of July 2, 2015. Outstanding share

and per-share amounts disclosed for all periods presented have been retroactively adjusted to reflect the effects of

the Stock Split.

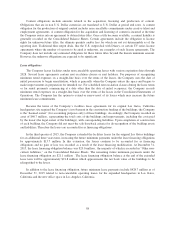

Preferred Stock

The Company has authorized 10,000,000 shares of undesignated preferred stock with a par value of $0.001

per share. None of the preferred shares were issued and outstanding at December 31, 2015 and 2014.

Voting Rights

The holders of each share of common stock shall be entitled to one vote per share on all matters to be voted

upon by the Company’s stockholders.

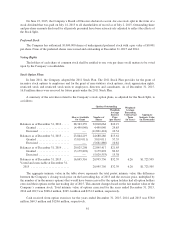

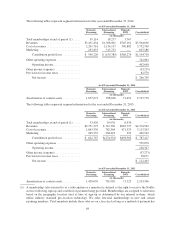

Stock Option Plans

In June 2011, the Company adopted the 2011 Stock Plan. The 2011 Stock Plan provides for the grant of

incentive stock options to employees and for the grant of non-statutory stock options, stock appreciation rights,

restricted stock and restricted stock units to employees, directors and consultants. As of December 31, 2015,

16.8 million shares were reserved for future grants under the 2011 Stock Plan.

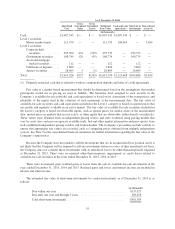

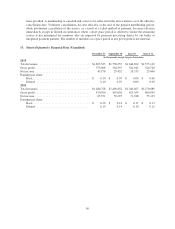

A summary of the activities related to the Company’s stock option plans, as adjusted for the Stock Split, is

as follows:

Shares Available

for Grant

Options Outstanding Weighted-

Average

Remaining

Contractual

Term

(in Years)

Aggregate

Intrinsic Value

(in Thousands)

Number of

Shares

Weighted-

Average

Exercise

Price

(per Share)

Balances as of December 31, 2012 ..... 28,343,259 32,010,664 $10.19

Granted ...................... (4,499,040) 4,499,040 29.85

Exercised ..................... — (11,821,418) 10.54

Balances as of December 31, 2013 ..... 23,844,219 24,688,286 $13.61

Granted ...................... (3,819,011) 3,819,011 57.55

Exercised ..................... — (5,661,880) 10.81

Balances as of December 31, 2014 ..... 20,025,208 22,845,417 $21.65

Granted ...................... (3,179,892) 3,179,892 82.67

Exercised ..................... — (5,029,553) 15.38

Balances as of December 31, 2015 ..... 16,845,316 20,995,756 $32.39 6.26 $1,723,505

Vested and exercisable at December 31,

2015 .......................... 20,995,756 $32.39 6.26 $1,723,505

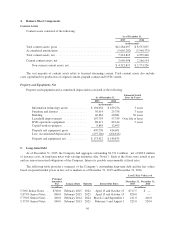

The aggregate intrinsic value in the table above represents the total pretax intrinsic value (the difference

between the Company’s closing stock price on the last trading day of 2015 and the exercise price, multiplied by

the number of in-the-money options) that would have been received by the option holders had all option holders

exercised their options on the last trading day of 2015. This amount changes based on the fair market value of the

Company’s common stock. Total intrinsic value of options exercised for the years ended December 31, 2015,

2014 and 2013 was $368.4 million, $265.1 million and $274.2 million, respectively.

Cash received from option exercises for the years ended December 31, 2015, 2014 and 2013 was $78.0

million, $60.5 million and $124.6 million, respectively.

61