NetFlix 2015 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2015 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

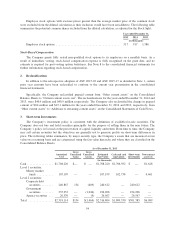

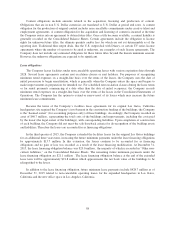

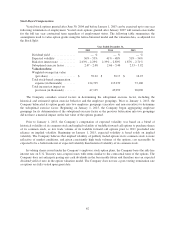

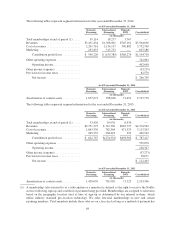

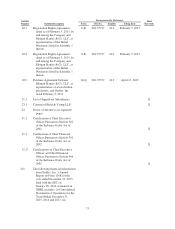

The components of provision for income taxes for all periods presented were as follows:

Year Ended December 31,

2015 2014 2013

(in thousands)

Current tax provision:

Federal .......................................... $52,557 $ 86,623 $ 58,558

State ............................................ (1,576) 9,866 15,154

Foreign .......................................... 26,918 16,144 7,003

Total current ................................. 77,899 112,633 80,715

Deferred tax provision:

Federal .......................................... (37,669) (10,994) (18,930)

State ............................................ (17,635) (17,794) (2,751)

Foreign .......................................... (3,351) (1,275) (363)

Total deferred ................................ (58,655) (30,063) (22,044)

Provision for income taxes .............................. $19,244 $ 82,570 $ 58,671

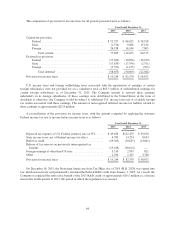

U.S. income taxes and foreign withholding taxes associated with the repatriation of earnings of certain

foreign subsidiaries were not provided for on a cumulative total of $65.3 million of undistributed earnings for

certain foreign subsidiaries as of December 31, 2015. The Company intends to reinvest these earnings

indefinitely in its foreign subsidiaries. If these earnings were distributed to the United States in the form of

dividends or otherwise, the Company would be subject to additional U.S. income taxes net of available foreign

tax credits associated with these earnings. The amount of unrecognized deferred income tax liability related to

these earnings is approximately $22.8 million.

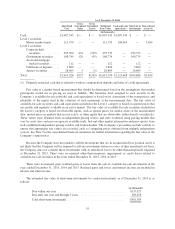

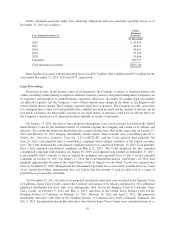

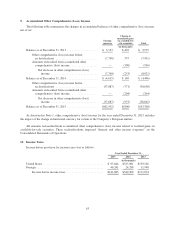

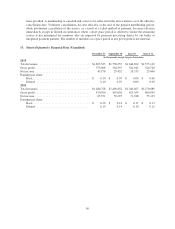

A reconciliation of the provision for income taxes, with the amount computed by applying the statutory

Federal income tax rate to income before income taxes is as follows:

Year Ended December 31,

2015 2014 2013

(in thousands)

Expected tax expense at U.S. Federal statutory rate of 35% ..... $49,658 $122,279 $ 59,878

State income taxes, net of Federal income tax effect .......... 4,783 13,274 8,053

R&D tax credit ........................................ (29,363) (18,655) (13,841)

Release of tax reserves on previously unrecognized tax

benefits ............................................ (13,438) (38,612) —

Foreign earnings at other than US rates .................... 5,310 2,959 821

Other ............................................... 2,294 1,325 3,760

Provision for income taxes .............................. $19,244 $ 82,570 $ 58,671

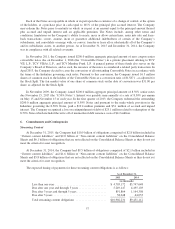

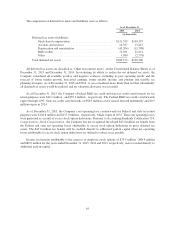

On December 18, 2015, the Protecting Americans from Tax Hikes Act of 2015 (H.R. 2029) was signed into

law which retroactively and permanently extended the Federal R&D credit from January 1, 2015. As a result, the

Company recognized the retroactive benefit of the 2015 R&D credit of approximately $16.5 million as a discrete

item in the fourth quarter of 2015, the period in which the legislation was enacted.

64