NetFlix 2015 Annual Report Download - page 64

Download and view the complete annual report

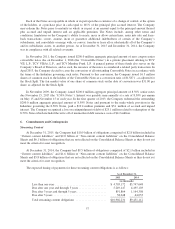

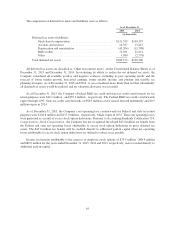

Please find page 64 of the 2015 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Netflix, Inc. Shareholder Derivative Litigation, Case No. 1-12-cv-218399, and lead counsel was appointed. A

consolidated complaint was filed on December 4, 2012, with plaintiffs seeking compensatory damages and other

relief. The consolidated complaint alleges, among other things, that certain of the Company’s current and former

officers and directors breached their fiduciary duties, issued false and misleading statements primarily regarding

the Company’s streaming business, violated accounting rules concerning segment reporting, violated provisions

of the California Corporations Code, and wasted corporate assets. The consolidated complaint further alleges that

the defendants caused the Company to buy back stock at artificially inflated prices to the detriment of the

Company and its shareholders while contemporaneously selling personally held Company stock. The Company

filed a demurrer to the consolidated complaint and a motion to stay the derivative litigation in favor of the related

federal securities class action on February 4, 2013. On June 21, 2013, the Court granted the motion to stay the

derivative litigation pending resolution of the related federal securities class action. Management has determined

a potential loss is reasonably possible however, based on its current knowledge, management does not believe

that the amount of such possible loss or a range of potential loss is reasonably estimable.

The Company is involved in other litigation matters not listed above but does not consider the matters to be

material either individually or in the aggregate at this time. The Company’s view of the matters not listed may

change in the future as the litigation and events related thereto unfold.

7. Guarantees—Indemnification Obligations

In the ordinary course of business, the Company has entered into contractual arrangements under which it

has agreed to provide indemnification of varying scope and terms to business partners and other parties with

respect to certain matters, including, but not limited to, losses arising out of the Company’s breach of such

agreements and out of intellectual property infringement claims made by third parties. In these circumstances,

payment may be conditional on the other party making a claim pursuant to the procedures specified in the

particular contract.

The Company’s obligations under these agreements may be limited in terms of time or amount, and in some

instances, the Company may have recourse against third parties for certain payments. In addition, the Company

has entered into indemnification agreements with its directors and certain of its officers that will require it,

among other things, to indemnify them against certain liabilities that may arise by reason of their status or service

as directors or officers. The terms of such obligations vary.

It is not possible to make a reasonable estimate of the maximum potential amount of future payments under

these or similar agreements due to the conditional nature of the Company’s obligations and the unique facts and

circumstances involved in each particular agreement. No amount has been accrued in the accompanying financial

statements with respect to these indemnification guarantees.

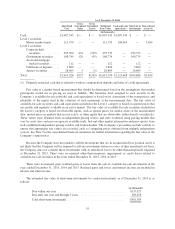

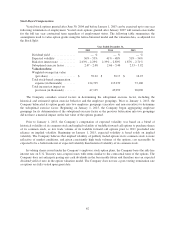

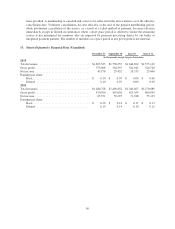

8. Stockholders’ Equity

In April 2013, the Company issued 16.3 million shares of common stock in connection with the conversion

of the Convertible Notes, as adjusted for the Stock Split. See Note 5 to the consolidated financial statements for

further details.

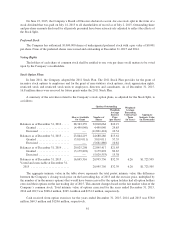

Stock Split

In March 2015, the Company’s Board of Directors adopted an amendment to the Company’s Certificate of

Incorporation, to increase the number of shares of capital stock the Company is authorized to issue from

170,000,000 ( 160,000,000 shares of common stock and 10,000,000 shares of preferred stock), par value $0.001

to 5,000,000,000 ( 4,990,000,000 shares of common stock and 10,000,000 shares of preferred stock), par value

$0.001. This amendment to the Company’s certificate of incorporation was approved by the Company’s

stockholders at the 2015 Annual Meeting held on June 9, 2015.

60