NetFlix 2015 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2015 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

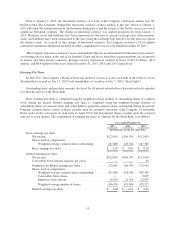

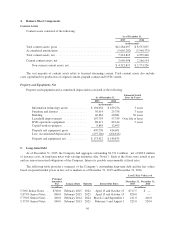

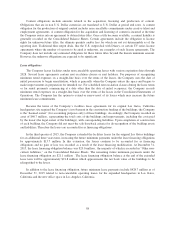

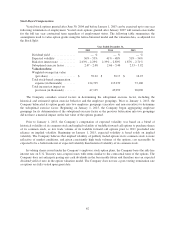

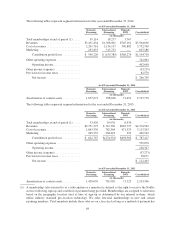

Future minimum payments under lease financing obligations and non-cancelable operating leases as of

December 31, 2015 are as follows:

Year Ending December 31,

Future

Minimum

Payments

(in thousands)

2016 .......................................................... $ 42,545

2017 .......................................................... 54,811

2018 .......................................................... 58,015

2019 .......................................................... 53,152

2020 .......................................................... 51,844

Thereafter ...................................................... 269,377

Total minimum payments ......................................... $529,744

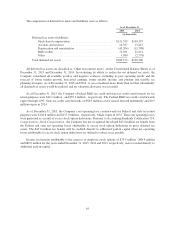

Rent expense associated with the operating leases was $34.7 million, $26.6 million and $27.9 million for the

years ended December 31, 2015, 2014 and 2013, respectively.

Legal Proceedings

From time to time, in the normal course of its operations, the Company is subject to litigation matters and

claims, including claims relating to employee relations, business practices and patent infringement. Litigation can

be expensive and disruptive to normal business operations. Moreover, the results of complex legal proceedings

are difficult to predict and the Company’s view of these matters may change in the future as the litigation and

events related thereto unfold. The Company expenses legal fees as incurred. The Company records a provision

for contingent losses when it is both probable that a liability has been incurred and the amount of the loss can be

reasonably estimated. An unfavorable outcome to any legal matter, if material, could have an adverse effect on

the Company’s operations or its financial position, liquidity or results of operations.

On January 13, 2012, the first of three purported shareholder class action lawsuits was filed in the United

States District Court for the Northern District of California against the Company and certain of its officers and

directors. Two additional purported shareholder class action lawsuits were filed in the same court on January 27,

2012 and February 29, 2012 alleging substantially similar claims. These lawsuits were consolidated into In re

Netflix, Inc., Securities Litigation, Case No. 3:12-cv-00225-SC, and the Court selected lead plaintiffs. On

June 26, 2012, lead plaintiffs filed a consolidated complaint which alleged violations of the federal securities

laws. The Court dismissed the consolidated complaint with leave to amend on February 13, 2013. Lead plaintiffs

filed a first amended consolidated complaint on March 22, 2013. The Court dismissed the first amended

consolidated complaint with prejudice on August 20, 2013, and judgment was entered on September 27, 2013.

Lead plaintiffs filed a motion to alter or amend the judgment and requested leave to file a second amended

complaint on October 25, 2013. On January 17, 2014, the Court denied that motion. On February 18, 2014, lead

plaintiffs appealed that decision to the United States Court of Appeals for the Ninth Circuit, oral argument has

been set for March 17, 2016. Management has determined a potential loss is reasonably possible however, based

on its current knowledge, management does not believe that the amount of such possible loss or a range of

potential loss is reasonably estimable.

On November 23, 2011, the first of six purported shareholder derivative suits was filed in the Superior Court

of California, Santa Clara County, against the Company and certain of its officers and directors. Five additional

purported shareholder derivative suits were subsequently filed: two in the Superior Court of California, Santa

Clara County on February 9, 2012 and May 2, 2012; and three in the United States District Court for the

Northern District of California on February 13, 2012, February 24, 2012 and April 2, 2012. The purported

shareholder derivative suits filed in the Northern District of California have been voluntarily dismissed. On

July 5, 2012, the purported shareholder derivative suits filed in Santa Clara County were consolidated into In re

59