NetFlix 2015 Annual Report Download - page 54

Download and view the complete annual report

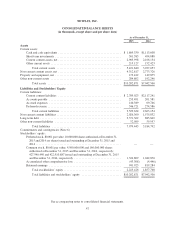

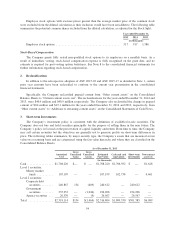

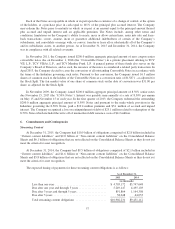

Please find page 54 of the 2015 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In April 2015, the FASB issued ASU 2015-03, Simplifying the Presentation of Debt Issuance Costs which

changes the presentation of debt issuance costs in financial statements. ASU 2015-03 requires an entity to present

such costs in the balance sheet as a direct deduction from the related debt liability rather than as an asset.

Amortization of the costs will continue to be reported as interest expense. The Company elected to early adopt

ASU 2015-03 as of December 31, 2015, and retrospectively reclassifed $14.2 million of debt issuance costs

associated with the Company’s long-term debt as of December 31, 2014 from other non-current assets to long-

term debt.

In November 2015, the FASB issued ASU 2015-17, Balance Sheet Classification of Deferred Taxes to

simplify the presentation of deferred income taxes. The amendments in this update require that deferred tax

liabilities and assets be classified as noncurrent in a classified statement of financial position. The Company has

elected to early adopt ASU 2015-17 as of December 31, 2015 and retrospectively applied ASU 2015-17 to all

periods presented. As of December 31, 2014 the Company reclassified $13.4 million of deferred tax assets from

“Other current assets” to “Other non-current assets” on the Consolidated Balance Sheets.

Accounting Guidance Not Yet Adopted

In May 2014, the FASB issued ASU 2014-09, Revenue from Contracts with Customers (Topic 606) which

amended the existing accounting standards for revenue recognition. ASU 2014-09 establishes principles for

recognizing revenue upon the transfer of promised goods or services to customers, in an amount that reflects the

expected consideration received in exchange for those goods or services. In July 2015, the FASB deferred the

effective date for annual reporting periods beginning after December 15, 2017 (including interim reporting

periods within those periods). Early adoption is permitted to the original effective date of December 15, 2016

(including interim reporting periods within those periods). The amendments may be applied retrospectively to

each prior period presented or retrospectively with the cumulative effect recognized as of the date of initial

application. The Company is currently in the process of evaluating the impact of adoption of the ASU on its

consolidated financial statements, but does not expect the impact to be material.

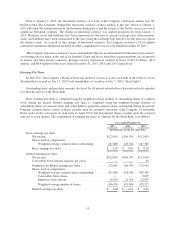

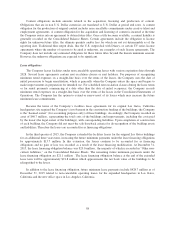

Cash Equivalents and Short-term Investments

The Company considers investments in instruments purchased with an original maturity of 90 days or less to

be cash equivalents. The Company also classifies amounts in transit from payment processors for customer credit

card and debit card transactions as cash equivalents.

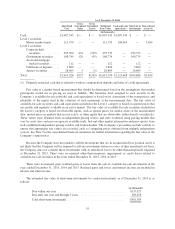

The Company classifies short-term investments, which consist of marketable securities with original

maturities in excess of 90 days as available-for-sale. Short-term investments are reported at fair value with

unrealized gains and losses included in “Accumulated other comprehensive loss” within Stockholders’ equity in

the Consolidated Balance Sheets. The amortization of premiums and discounts on the investments, realized gains

and losses, and declines in value judged to be other-than-temporary on available-for-sale securities are included

in “Interest and other income (expense)” in the Consolidated Statements of Operations. The Company uses the

specific identification method to determine cost in calculating realized gains and losses upon the sale of short-

term investments.

Short-term investments are reviewed periodically to identify possible other-than-temporary impairment.

When evaluating the investments, the Company reviews factors such as the length of time and extent to which

fair value has been below cost basis, the financial condition of the issuer, the Company’s intent to sell, or

whether it would be more likely than not that the Company would be required to sell the investments before the

recovery of their amortized cost basis.

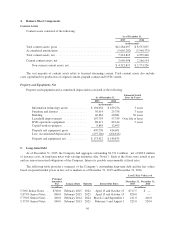

Streaming Content

The Company acquires, licenses and produces content, including original programming, in order to offer

members unlimited viewing of TV shows and films. The content licenses are for a fixed fee and specific

50