NetFlix 2015 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2015 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

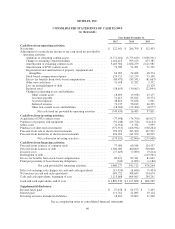

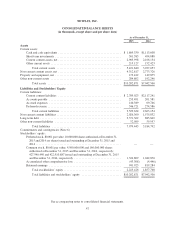

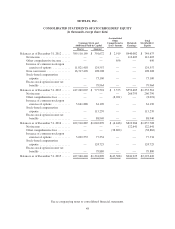

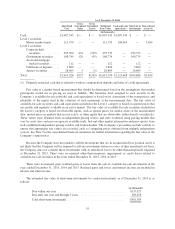

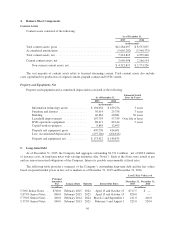

NETFLIX, INC.

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

(in thousands, except share data)

Common Stock and

Additional Paid-in Capital

Accumulated

Other

Comprehensive

(Loss) Income

Retained

Earnings

Total

Stockholders’

Equity

Shares Amount

Balances as of December 31, 2012 ...... 389,110,169 $ 301,672 $ 2,919 $440,082 $ 744,673

Net income .................... — — — 112,403 112,403

Other comprehensive income ...... — — 656 — 656

Issuance of common stock upon

exercise of options ............ 11,821,418 124,557 — — 124,557

Note conversion ................ 16,317,420 198,208 — — 198,208

Stock-based compensation

expense ..................... — 73,100 — — 73,100

Excess stock option income tax

benefits ..................... — 79,964 — — 79,964

Balances as of December 31, 2013 ...... 417,249,007 $ 777,501 $ 3,575 $552,485 $1,333,561

Net income .................... — — — 266,799 266,799

Other comprehensive loss ......... — — (8,021) — (8,021)

Issuance of common stock upon

exercise of options ............ 5,661,880 61,190 — — 61,190

Stock-based compensation

expense ..................... — 115,239 — — 115,239

Excess stock option income tax

benefits ..................... — 88,940 — — 88,940

Balances as of December 31, 2014 ...... 422,910,887 $1,042,870 $ (4,446) $819,284 $1,857,708

Net income .................... — — — 122,641 122,641

Other comprehensive loss ......... — — (38,862) — (38,862)

Issuance of common stock upon

exercise of options ............ 5,029,553 77,334 — — 77,334

Stock-based compensation

expense ..................... — 124,725 — — 124,725

Excess stock option income tax

benefits ..................... — 79,880 — — 79,880

Balances as of December 31, 2015 ...... 427,940,440 $1,324,809 $(43,308) $941,925 $2,223,426

See accompanying notes to consolidated financial statements.

48