NetFlix 2009 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2009 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NETFLIX, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

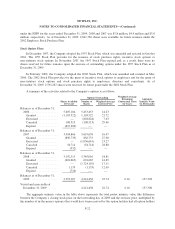

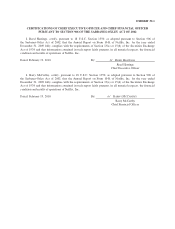

The tax effects of temporary differences and tax carryforwards that give rise to significant portions of the

deferred tax assets are presented below (in thousands):

Year Ended December 31,

2009 2008

Deferred tax assets:

Accruals and reserves ........................................ $ 1,144 $ 1,378

Depreciation ............................................... (3,259) 2,947

Stock-based compensation .................................... 16,824 17,440

R&D credits ................................................ 3,178 2,636

Other ..................................................... 1,166 1,103

Deferred tax assets .............................................. $19,053 $25,504

In evaluating its ability to realize the deferred tax assets, the Company considered all available positive and

negative evidence, including its past operating results and the forecast of future market growth, forecasted

earnings, future taxable income, and prudent and feasible tax planning strategies. As of December 31, 2009 and

2008, it was considered more likely than not that substantially all deferred tax assets would be realized, and no

valuation allowance was recorded.

The Company classifies gross interest and penalties and unrecognized tax benefits that are not expected to

result in payment or receipt of cash within one year as non-current liabilities in the consolidated balance sheet.

As of December 31, 2009, the total amount of gross unrecognized tax benefits was $13.2 million, of which $10.7

million, if recognized, would favorably impact the Company’s effective tax rate. As of December 31, 2008, the

Company had $10.9 million gross unrecognized benefits, of which $8.7 million, if recognized, would favorably

impact the Company’s effective tax rate. The Company’s unrecognized tax benefits are classified as other

non-current liabilities in the Consolidated Balance Sheet. The aggregate changes in the Company’s total gross

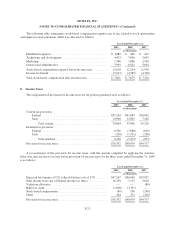

amount of unrecognized tax benefits are summarized as follows (in thousands):

Balance as of December 31, 2007 .............................................. $ —

Increases related to tax positions taken during the current period .................. 10,859

Balance as of December 31, 2008 .............................................. $10,859

Increases related to tax positions taken during the current period .................. 2,385

Balance as of December 31, 2009 .............................................. $13,244

The Company includes interest and penalties related to unrecognized tax benefits within the provision for

income taxes. As of the date of adoption, the Company had no accrued gross interest and penalties relating to

unrecognized tax benefits. As of December 31, 2009, the total amount of gross interest and penalties accrued was

$0.9 million, which is classified as other non-current liabilities in the consolidated balance sheet.

The Company files income tax returns in the U.S. federal jurisdiction and all of the states where income tax

is imposed. The Company is subject to US federal income tax examinations by the IRS for years after 2000 and

state income tax examination by state taxing authorities for years after 1999. The Company does not believe it is

reasonably possible that its unrecognized tax benefits would significantly change over the next twelve months.

F-26