NetFlix 2009 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2009 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NETFLIX, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

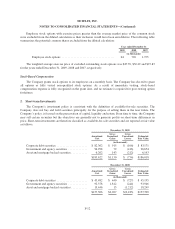

Cash Equivalents and Short-term Investments

The Company considers investments in instruments purchased with an original maturity of 90 days or less to

be cash equivalents. The Company classifies short-term investments, which consist of marketable securities with

original maturities in excess of 90 days as available-for-sale. Short-term investments are reported at fair value

with unrealized gains and losses included in accumulated other comprehensive income within stockholders’

equity in the consolidated balance sheet. The amortization of premiums and discounts on the investments,

realized gains and losses, and declines in value judged to be other-than-temporary on available-for-sale securities

are included in interest and other income in the consolidated statements of operations. The Company uses the

specific identification method to determine cost in calculating realized gains and losses upon the sale of short-

term investments.

Short-term investments are reviewed periodically to identify possible other-than-temporary impairment.

When evaluating the investments, the Company reviews factors such as the length of time and extent to which

fair value has been below cost basis, the financial condition of the issuer, the Company’s intent to sell, or

whether it would be more likely than not that the Company would be required to sell the investments before the

recovery of their amortized cost basis.

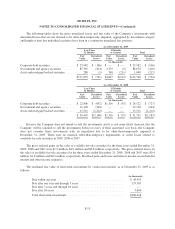

Content Library

The Company obtains content through direct purchases, revenue sharing agreements and license agreements

with studios, distributors and other suppliers. DVD content is obtained through direct purchases or revenue

sharing agreements. Streaming content is generally licensed for a fixed fee for the term of the license agreement

but may also be obtained through a revenue sharing agreement.

The Company acquires DVD content for the purpose of rental to its subscribers and earns subscription rental

revenues, and, as such, the Company considers its DVD library to be a productive asset. Accordingly, the

Company classifies its DVD library as a non-current asset on its consolidated balance sheets. Additionally, cash

outflows for the acquisition of the DVD library, net of changes in related accounts payable, are classified as cash

flows from investing activities in the Company’s consolidated statements of cash flows. This is inclusive of any

upfront non-refundable payments required under revenue sharing agreements.

The Company amortizes its direct purchase DVDs, less estimated salvage value, on a “sum-of-the-months”

accelerated basis over their estimated useful lives. The useful life of the new release DVDs and back catalog

DVDs is estimated to be one year and three years, respectively. In estimating the useful life of its DVDs, the

Company takes into account library utilization as well as an estimate for lost or damaged DVDs. The Company

provides a salvage value for those direct purchase DVDs that the Company estimates it will sell at the end of

their useful lives. For those DVDs that the Company does not expect to sell, no salvage value is provided.

Additionally, the terms of certain DVD purchase agreements with studios and distributors provide for

volume purchase discounts or rebates based on achieving specified performance levels. Volume purchase

discounts are recorded as a reduction of DVD library when earned. The Company accrues for rebates as earned

based on historical title performance and estimates of demand for the titles over the remainder of the title term.

Actual rebates may vary which could result in an increase or reduction in the estimated amounts previously

accrued.

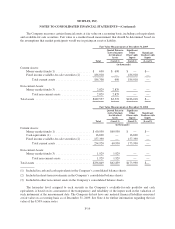

The Company obtains content distribution rights in order to stream movies and TV episodes without

commercial interruption to subscribers’ computers and TVs via Netflix Ready Devices. The Company accounts

for streaming content in accordance with the Financial Accounting Standards Board’s (“FASB”) Accounting

F-8