NetFlix 2009 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2009 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Indemnifications

In the ordinary course of business, we enter into contractual arrangements under which we agree to provide

indemnification of varying scope and terms to business partners and other parties with respect to certain matters,

including, but not limited to, losses arising out of our breach of such agreements and out of intellectual property

infringement claims made by third parties. In these circumstances, payment may be conditional on the other party

making a claim pursuant to the procedures specified in the particular contract. Further, our obligations under

these agreements may be limited in terms of time and/or amount, and in some instances, we may have recourse

against third parties for certain payments. In addition, we have entered into indemnification agreements with our

directors and certain of our officers that will require us, among other things, to indemnify them against certain

liabilities that may arise by reason of their status or service as directors or officers. The terms of such obligations

vary.

Item 7A. Quantitative and Qualitative Disclosures about Market Risk

The primary objective of our investment activities is to preserve principal, while at the same time

maximizing income we receive from investments without significantly increased risk. To achieve this objective,

we follow an established investment policy and set of guidelines to monitor and help mitigate our exposure to

interest rate and credit risk. The policy sets forth credit quality standards and limits our exposure to any one

issuer, as well as our maximum exposure to various asset classes. We maintain a portfolio of cash equivalents

and short-term investments in a variety of securities. These securities are classified as available-for-sale and are

recorded at fair value with unrealized gains and losses, net of tax, included in accumulated other comprehensive

income within stockholders equity in the consolidated balance sheet.

As of December 31, 2009, we had no material impairment charges associated with our short-term

investment portfolio. Although we believe our current investment portfolio has very little risk of material

impairment, we cannot predict future market conditions or market liquidity and can provide no assurance that our

investment portfolio will remain materially unimpaired. Some of the securities we invest in may be subject to

market risk due to changes in prevailing interest rates which may cause the principal amount of the investment to

fluctuate. For example, if we hold a security that was issued with a fixed interest rate at the then-prevailing rate

and the prevailing interest rate later rises, the value of our investment will decline. At December 31, 2009, our

cash equivalents were generally invested in money market funds, which are not subject to market risk because

the interest paid on such funds fluctuates with the prevailing interest rate. Our short-term investments were

comprised of corporate debt securities, government and agency securities and asset and mortgage-backed

securities. Approximately 52% of the portfolio is invested in government and agency issued securities.

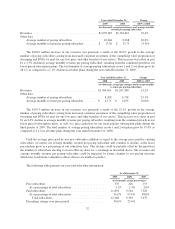

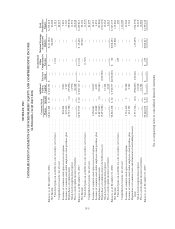

At December 31, 2009, we had securities classified as short-term investments of $186.0 million. Changes in

interest rates could adversely affect the market value of these investments. The table below separates these

investments, based on stated maturities, to show the approximate exposure to interest rates.

(in thousands)

Due within one year .............................................. $ 44,455

Due within five years ............................................. 137,763

Due within ten years ............................................. —

Due after ten years ............................................... 3,800

Total .......................................................... $186,018

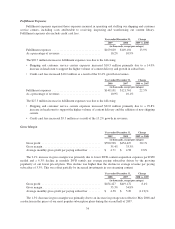

A sensitivity analysis was performed on our investment portfolio as of December 31, 2009. The analysis is

based on an estimate of the hypothetical changes in market value of the portfolio that would result from an

immediate parallel shift in the yield curve of various magnitudes. This methodology assumes a more immediate

change in interest rates to reflect the current economic environment.

42