NetFlix 2009 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2009 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.expense is fully recognized on the grant date and no estimate is required for post-vesting option forfeitures. We

also issue shares through our employee stock purchase program (“ESPP”) which has been determined to be

compensatory in nature. Stock-based compensation expense for shares issued under this program is expensed

over the offering period of six months.

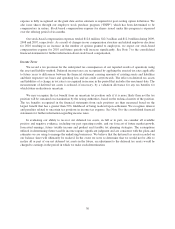

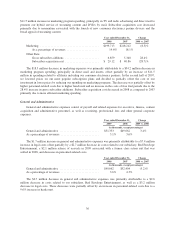

Our stock-based compensation expenses totaled $12.6 million, $12.3 million and $12.0 million during 2009,

2008 and 2007, respectively. As a result of changes in our compensation structure and related employee elections

for 2010 resulting in an increase in the number of options granted to employees, we expect our stock-based

compensation expense for 2010 and future periods will increase significantly. See Note 7 to the consolidated

financial statements for further information about stock based compensation.

Income Taxes

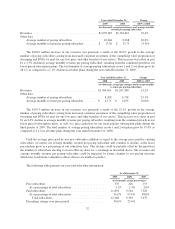

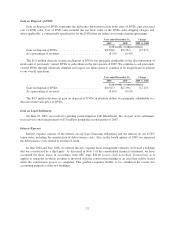

We record a tax provision for the anticipated tax consequences of our reported results of operations using

the asset and liability method. Deferred income taxes are recognized by applying the enacted tax rates applicable

to future years to differences between the financial statement carrying amounts of existing assets and liabilities

and their respective tax bases and operating loss and tax credit carryforwards. The effect on deferred tax assets

and liabilities of a change in tax rates is recognized in income in the period that includes the enactment date. The

measurement of deferred tax assets is reduced, if necessary, by a valuation allowance for any tax benefits for

which future realization is uncertain.

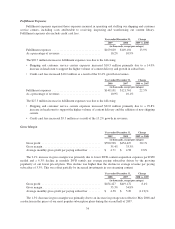

We may recognize the tax benefit from an uncertain tax position only if it is more likely than not the tax

position will be sustained on examination by the taxing authorities, based on the technical merits of the position.

The tax benefits recognized in the financial statements from such positions are then measured based on the

largest benefit that has a greater than 50% likelihood of being realized upon settlement. We recognize interest

and penalties related to uncertain tax positions in income tax expense. See Note 8 to the consolidated financial

statements for further information regarding income taxes.

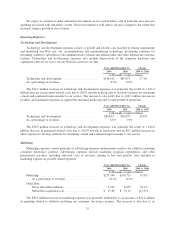

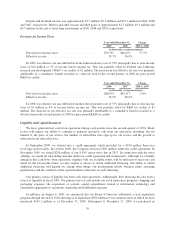

In evaluating our ability to recover our deferred tax assets, in full or in part, we consider all available

positive and negative evidence, including our past operating results, and our forecast of future market growth,

forecasted earnings, future taxable income and prudent and feasible tax planning strategies. The assumptions

utilized in determining future taxable income require significant judgment and are consistent with the plans and

estimates we are using to manage the underlying businesses. We believe that the deferred tax assets recorded on

our balance sheet will ultimately be realized. In the event we were to determine that we would not be able to

realize all or part of our net deferred tax assets in the future, an adjustment to the deferred tax assets would be

charged to earnings in the period in which we make such determination.

30