NetFlix 2009 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2009 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

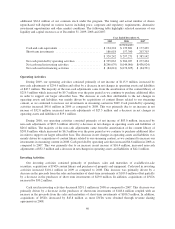

Interest and dividend income was approximately $3.7 million, $9.2 million and $19.7 million in 2009, 2008

and 2007, respectively. Interest and other income included gains of approximately $1.5 million, $3.1 million and

$0.7 million on the sale of short-term investments in 2009, 2008 and 2007, respectively.

Provision for Income Taxes

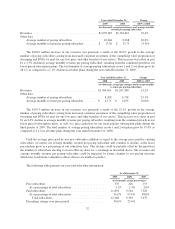

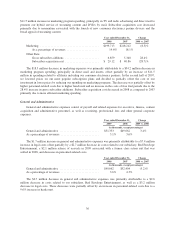

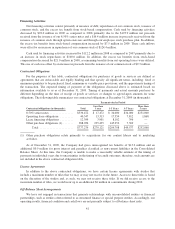

Year ended December 31, Change

2009 2008 2009 vs. 2008

(in thousands, except percentages)

Provision for income taxes ........................... $76,332 $48,474 57.5%

Effective tax rate ................................... 39.7% 36.9%

In 2009, our effective tax rate differed from the federal statutory rate of 35% principally due to state income

taxes of $10 million or 5% of income before income tax. This was partially offset by Federal and California

research and development (“R&D”) tax credits of $2 million. The increase in our effective tax rate was primarily

attributable to a cumulative benefit recorded as a discrete item in the second quarter of 2008 for prior period

R&D tax credits.

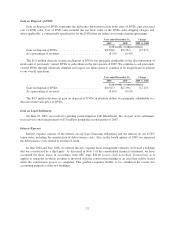

Year ended December 31, Change

2008 2007 2008 vs. 2007

(in thousands, except percentages)

Provision for income taxes ........................... $48,474 $44,317 9.4%

Effective tax rate ................................... 36.9% 40.0%

In 2008, our effective tax rate differed from the federal statutory rate of 35% principally due to state income

taxes of $5 million or 4% of income before income tax. This was partially offset by R&D tax credits of $3

million. The decrease in our effective tax rate was primarily attributable to a cumulative benefit recorded as a

discrete item in the second quarter of 2008 for prior period R&D tax credits.

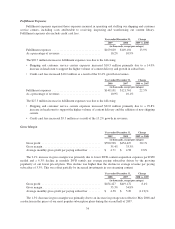

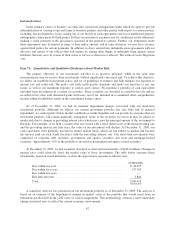

Liquidity and Capital Resources

We have generated net cash from operations during each quarter since the second quarter of 2001. Many

factors will impact our ability to continue to generate and grow cash from our operations including, but not

limited to, the price of our service, the number of subscribers who sign up for our service and the growth or

reduction in our subscriber base.

In September 2009, we entered into a credit agreement which provided for a $100 million three-year

revolving credit facility. In October 2009, the Company borrowed $20 million under the credit agreement. In

November 2009, we issued $200 million of our 8.50% senior notes due in 2017. In connection with the notes

offering, we repaid all outstanding amounts under our credit agreement and terminated it. Although we currently

anticipate that cash flows from operations, together with our available funds, will be sufficient to meet our cash

needs for the foreseeable future, we may require or choose to obtain additional financing. Our ability to obtain

additional financing will depend on, among other things, our development efforts, business plans, operating

performance and the condition of the capital markets at the time we seek financing.

Our primary source of liquidity has been cash from operations. Additionally, debt financing has also been a

source of liquidity in fiscal 2009. Our primary uses of cash include our stock repurchase programs, shipping and

packaging expenses, the acquisition of content, capital expenditures related to information technology and

automation equipment for operations, marketing and fulfillment expenses.

In addition, on August 6, 2009, we announced that our Board of Directors authorized a stock repurchase

program through the end of 2010 allowing us to repurchase $300 million of our common stock of which we have

purchased $149.1 million as of December 31, 2009. Subsequent to December 31, 2009, we purchased an

39