NetFlix 2009 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2009 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NETFLIX, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

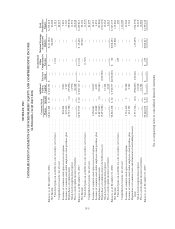

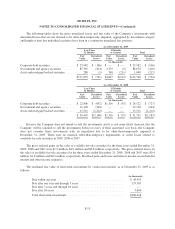

The following tables show the gross unrealized losses and fair value of the Company’s investments with

unrealized losses that are not deemed to be other-than-temporarily impaired, aggregated by investment category

and length of time that individual securities have been in a continuous unrealized loss position:

As of December 31, 2009

Less Than

12 Months

12 Months

or Greater Total

Fair

Value

Unrealized

Losses

Fair

Value

Unrealized

Losses

Fair

Value

Unrealized

Losses

(in thousands)

Corporate debt securities ................ $ 25,982 $ (106) $ — $ — $ 25,982 $ (106)

Government and agency securities ........ 85,391 (414) 3,279 (2) 88,670 (416)

Asset and mortgage backed securities ...... 280 (1) 768 (211) 1,048 (212)

$111,653 $ (521) $4,047 $(213) $115,700 $ (734)

As of December 31, 2008

Less Than

12 Months

12 Months

or Greater Total

Fair

Value

Unrealized

Losses

Fair

Value

Unrealized

Losses

Fair

Value

Unrealized

Losses

(in thousands)

Corporate debt securities ................ $ 22,806 $ (692) $1,316 $ (35) $ 24,122 $ (727)

Government and agency securities ........ 12,128 (244) — — 12,128 (244)

Asset and mortgage backed securities ...... 15,511 (1,212) — — 15,511 (1,212)

$ 50,445 $(2,148) $1,316 $ (35) $ 51,761 $(2,183)

Because the Company does not intend to sell the investments and it is not more likely than not that the

Company will be required to sell the investments before recovery of their amortized cost basis, the Company

does not consider those investments with an unrealized loss to be other-than-temporarily impaired at

December 31, 2009. There were no material other-than-temporary impairments or credit losses related to

available-for-sale securities in 2009, 2008 or 2007.

The gross realized gains on the sales of available-for-sale securities for the three years ended December 31,

2009, 2008 and 2007 were $1.9 million, $4.9 million and $0.8 million, respectively. The gross realized losses on

the sales of available-for-sale securities for the three years ended December 31, 2009, 2008 and 2007 were $0.4

million, $1.8 million and $0.1 million, respectively. Realized gains and losses and interest income are included in

interest and other income (expense).

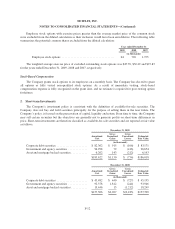

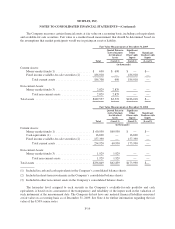

The estimated fair value of short-term investments by contractual maturity as of December 31, 2009 is as

follows:

(in thousands)

Due within one year .............................................. $ 44,455

Due after one year and through 5 years ............................... 137,763

Due after 5 years and through 10 years ............................... —

Due after 10 years ............................................... 3,800

Total short-term investments ....................................... $186,018

F-13