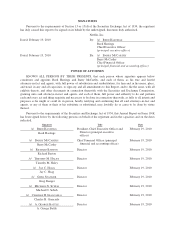

NetFlix 2009 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2009 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NETFLIX, INC.

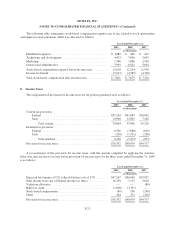

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

6. Guarantees—Intellectual Property Indemnification Obligations

In the ordinary course of business, the Company has entered into contractual arrangements under which it

has agreed to provide indemnification of varying scope and terms to business partners and other parties with

respect to certain matters, including, but not limited to, losses arising out of the Company’s breach of such

agreements and out of intellectual property infringement claims made by third parties.

The Company’s obligations under these agreements may be limited in terms of time or amount, and in some

instances, the Company may have recourse against third parties for certain payments. In addition, the Company

has entered into indemnification agreements with its directors and certain of its officers that will require it,

among other things, to indemnify them against certain liabilities that may arise by reason of their status or service

as directors or officers. The terms of such obligations vary.

It is not possible to make a reasonable estimate of the maximum potential amount of future payments under

these or similar agreements due to the conditional nature of the Company’s obligations and the unique facts and

circumstances involved in each particular agreement. No amount has been accrued in the accompanying financial

statements with respect to these indemnification guarantees.

7. Stockholders’ Equity

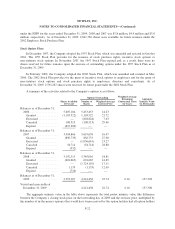

On August 6, 2009, the Company announced that its Board of Directors authorized a stock repurchase plan

that enables the Company to repurchase up to $300 million of its common stock through the end of 2010. The

timing and actual number of shares repurchased will depend on various factors including price, corporate and

regulatory requirements, alternative investment opportunities and other market conditions. Under this program,

the Company repurchased 3,197,459 shares of common stock at an average price of approximately $47 per share

for an aggregate amount of $149 million. Of this amount, 1,480,000 shares repurchased were initially held as

treasury stock and accordingly repurchases were accounted for at cost under the treasury method. These shares

were subsequently retired. The remaining 1,717,459 shares repurchased have also been retired. Subsequent to

December 31, 2009, the Company repurchased 1,010,000 shares of common stock at an average price of

approximately $62 for an aggregate amount of $62.4 million. The timing and actual number of shares

repurchased will depend on various factors including price, corporate and regulatory requirements, alternative

investment opportunities and other market conditions.

On January 26, 2009, the Company announced that its Board of Directors authorized a stock repurchase

program for 2009. Under this program, the Company repurchased 4,173,855 shares of common stock at an

average price of approximately $42 per share for an aggregate amount of approximately $175 million. Shares

repurchased under this program were initially held as treasury stock and accordingly repurchases were accounted

for at cost under the treasury method. These shares were subsequently retired. This program terminated on

August 6, 2009.

On March 5, 2008, the Company’s Board of Directors authorized a stock repurchase program allowing the

Company to repurchase up to $150 million of its common stock through the end of 2008. Under this program, the

Company repurchased 3,491,084 shares of common stock at an average price of approximately $29 per share for

an aggregate amount of $100 million. Shares repurchased under this program were initially held as treasury stock

and accordingly repurchases were accounted for under the treasury method. These shares have been subsequently

retired.

On January 31, 2008, the Company’s Board of Directors authorized a stock repurchase program allowing

the Company to repurchase up to $100 million of its common stock through the end of 2008. Under this program,

the Company repurchased 3,847,062 shares of common stock at an average price of approximately $26 per share

for an aggregate amount of $100 million. Shares repurchased under this program have been retired.

F-20