NetFlix 2009 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2009 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

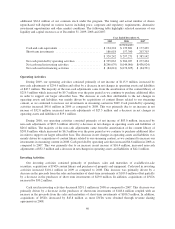

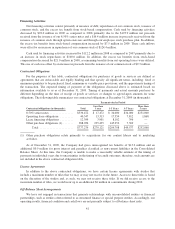

additional $62.4 million of our common stock under the program. The timing and actual number of shares

repurchased will depend on various factors including price, corporate and regulatory requirements, alternative

investment opportunities and other market conditions. The following table highlights selected measures of our

liquidity and capital resources as of December 31, 2009, 2008 and 2007:

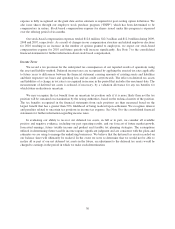

Year Ended December 31,

2009 2008 2007

(in thousands)

Cash and cash equivalents ............................ $134,224 $ 139,881 $ 177,439

Short-term investments .............................. 186,018 157,390 207,703

$ 320,242 $ 297,271 $ 385,142

Net cash provided by operating activities ................ $325,063 $ 284,037 $ 277,424

Net cash used in investing activities .................... $(246,079) $(144,960) $(436,024)

Net cash used in financing activities .................... $ (84,641) $(176,635) $ (64,391)

Operating Activities

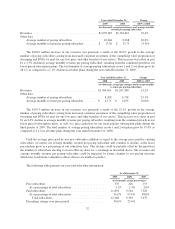

During 2009, our operating activities consisted primarily of net income of $115.9 million, increased by

non-cash adjustments of $254.9 million and offset by a decrease in net changes in operating assets and liabilities

of $45.7 million. The majority of the non-cash adjustments came from the amortization of the content library of

$219.5 million which increased by $9.7 million over the prior period as we continue to purchase additional titles

in order to support our larger subscriber base. The decrease in cash flow attributable to the net changes in

operating assets and liabilities was mainly driven by acquisitions of content library related to our streaming

content, as we continued to increase our investments in streaming content in 2009. Cash provided by operating

activities increased $41.0 million in 2009 as compared to 2008. This was primarily due to an increase in net

income of $32.8 million, increased non-cash adjustments of $27.3 million and a decrease in net changes in

operating assets and liabilities of $19.1 million.

During 2008, our operating activities consisted primarily of net income of $83.0 million, increased by

non-cash adjustments of $227.6 million offset by a decrease in net changes in operating assets and liabilities of

$26.6 million. The majority of the non-cash adjustments came from the amortization of the content library of

$209.8 million which increased by $6.3 million over the prior period as we continue to purchase additional titles

in order to support our larger subscriber base. The decrease in net changes in operating assets and liabilities was

mainly driven by acquisitions of content library related to our streaming content, as we continued to increase our

investments in streaming content in 2008. Cash provided by operating activities increased $6.6 million in 2008 as

compared to 2007. This was primarily due to an increase in net income of $16.4 million, increased non-cash

adjustments of $32.3 million and a decrease in net changes in operating assets and liabilities of $42.1 million.

Investing Activities

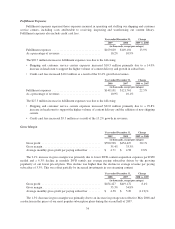

Our investing activities consisted primarily of purchases, sales and maturities of available-for-sale

securities, acquisitions of DVD content library and purchases of property and equipment. Cash used in investing

activities increased $101.1 million in 2009 as compared to 2008. This increase was primarily driven by a

decrease in the proceeds from the sales and maturities of short-term investments of $105.0 million offset partially

by a decrease in the purchases of short term investments of $29.0 million. In addition, acquisitions of DVDs

increased by $30.2 million.

Cash used in investing activities decreased $291.1 million in 2008 as compared to 2007. This decrease was

primarily driven by a decrease in the purchases of short-term investments of $148.4 million coupled with an

increase in the proceeds from the sales and maturities of short-term investments of $106.5 million. In addition,

acquisitions of DVDs decreased by $45.8 million as more DVDs were obtained through revenue sharing

agreements in 2008.

40