NetFlix 2009 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2009 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

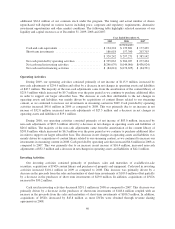

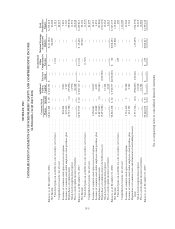

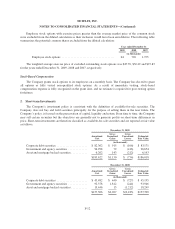

NETFLIX, INC.

CONSOLIDATED BALANCE SHEETS

(in thousands, except share and per share data)

As of December 31,

2009 2008

Assets

Current assets:

Cash and cash equivalents .............................................. $134,224 $ 139,881

Short-term investments ................................................ 186,018 157,390

Prepaid expenses ..................................................... 12,491 8,122

Prepaid revenue sharing expenses ........................................ 17,133 18,417

Current content library, net ............................................. 37,329 18,691

Other current assets ................................................... 23,818 16,424

Total current assets ............................................... 411,013 358,925

Content library, net ....................................................... 108,810 98,547

Property and equipment, net ................................................ 131,653 124,948

Deferred tax assets ........................................................ 15,958 22,409

Other non-current assets ................................................... 12,300 10,595

Total assets ...................................................... $679,734 $ 615,424

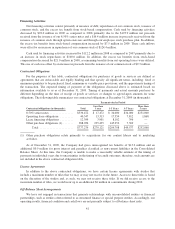

Liabilities and Stockholders’ Equity

Current liabilities:

Accounts payable ..................................................... $ 91,475 $ 100,344

Accrued expenses ..................................................... 33,387 31,394

Current portion of lease financing obligations .............................. 1,410 1,152

Deferred revenue ..................................................... 100,097 83,127

Total current liabilities ............................................. 226,369 216,017

Long-term debt ........................................................... 200,000 —

Lease financing obligations, excluding current portion ............................ 36,572 37,988

Other non-current liabilities ................................................. 17,650 14,264

Total liabilities ................................................... 480,591 268,269

Commitments and contingencies

Stockholders’ equity:

Preferred stock, $0.001 par value; 10,000,000 shares authorized at December 31,

2009 and 2008; no shares issued and outstanding at December 31, 2009 and

2008 ............................................................. — —

Common stock, $0.001 par value; 160,000,000 shares authorized at December 31,

2009 and 2008; 53,440,073 and 58,862,478 issued and outstanding at

December 31, 2009 and 2008, respectively ............................... 53 62

Additional paid-in capital .............................................. — 338,577

Treasury stock at cost (3,491,084 shares at December 31, 2008) ................ — (100,020)

Accumulated other comprehensive income ................................. 273 84

Retained earnings ..................................................... 198,817 108,452

Total stockholders’ equity .......................................... 199,143 347,155

Total liabilities and stockholders’ equity ............................... $679,734 $ 615,424

See accompanying notes to consolidated financial statements.

F-3