NetFlix 2009 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2009 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NETFLIX, INC.

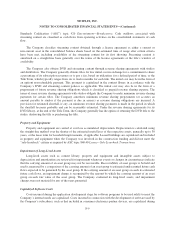

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Standards Codification (“ASC”) topic 920 Entertainment—Broadcasters. Cash outflows associated with

streaming content are classified as cash flows from operating activities on the consolidated statements of cash

flow.

The Company classifies streaming content obtained through a license agreement as either a current or

non-current asset in the consolidated balance sheets based on the estimated time of usage after certain criteria

have been met, including availability of the streaming content for its first showing. Streaming content is

amortized on a straight-line basis generally over the terms of the license agreements or the title’s window of

availability.

The Company also obtains DVD and streaming content through revenue sharing agreements with studios

and distributors. The Company generally obtains titles for low initial cost in exchange for a commitment to share

a percentage of its subscription revenues or to pay a fee, based on utilization, for a defined period of time, or the

Title Term, which typically ranges from six to twelve months for each title. The initial cost may be in the form of

an upfront non-refundable payment. This payment is capitalized in the content library in accordance with the

Company’s DVD and streaming content policies as applicable. The initial cost may also be in the form of a

prepayment of future revenue sharing obligations which is classified as prepaid revenue sharing expense. The

terms of some revenue sharing agreements with studios obligate the Company to make minimum revenue sharing

payments for certain titles. The Company amortizes minimum revenue sharing prepayments (or accretes an

amount payable to studios if the payment is due in arrears) as revenue sharing obligations are incurred. A

provision for estimated shortfall, if any, on minimum revenue sharing payments is made in the period in which

the shortfall becomes probable and can be reasonably estimated. Under the revenue sharing agreements for its

DVD library, at the end of the Title Term, the Company generally has the option of returning the DVD title to the

studio, destroying the title or purchasing the title.

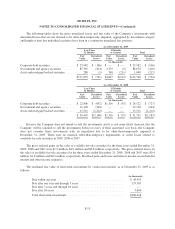

Property and Equipment

Property and equipment are carried at cost less accumulated depreciation. Depreciation is calculated using

the straight-line method over the shorter of the estimated useful lives of the respective assets, generally up to 30

years, or the lease term for leasehold improvements, if applicable. Leased buildings are capitalized and included

in property and equipment when the Company was involved in the construction funding and did not meet the

“sale-leaseback” criteria as required by ASC topic 840.40 Leases—Sale-Leaseback Transactions.

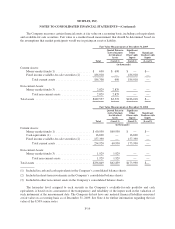

Impairment of Long-Lived Assets

Long-lived assets such as content library, property and equipment and intangible assets subject to

depreciation and amortization are reviewed for impairment whenever events or changes in circumstances indicate

that the carrying amount of an asset group may not be recoverable. Recoverability of asset groups to be held and

used is measured by a comparison of the carrying amount of an asset group to estimated undiscounted future cash

flows expected to be generated by the asset group. If the carrying amount of an asset group exceeds its estimated

future cash flows, an impairment charge is recognized by the amount by which the carrying amount of an asset

group exceeds fair value of the asset group. The Company evaluated its long-lived assets, and impairment

charges were not material for any of the years presented.

Capitalized Software Costs

Costs incurred during the application development stage for software programs to be used solely to meet the

Company’s internal needs are capitalized. Costs incurred in connection with the development of software used by

the Company’s subscribers, such as that included in consumer electronics partner devices, are capitalized during

F-9