NetFlix 2009 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2009 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Accordingly, we have recorded assets on our balance sheet for the costs paid by our lessor to construct our

headquarters facilities, along with corresponding financing liabilities for amounts equal to these lessor-paid

construction costs. The monthly rent payments we make to our lessor under our lease agreements are recorded in

our financial statements as land lease expense and principal and interest on the financing liabilities. Interest

expense on lease financing obligations reflects the portion of our monthly lease payments that is allocated to

interest expense.

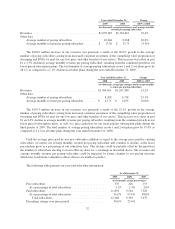

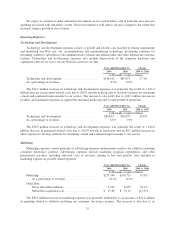

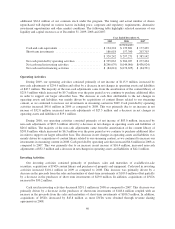

Year ended December 31, Change

2009 2008 2009 vs. 2008

(in thousands, except percentages)

Interest Expense ................................... $6,475 $2,458 163.4%

As a percentage of revenues .......................... 0.4% 0.2%

The $4.0 million increase in interest expense is entirely attributable to the interest expense associated with

our 8.50% senior notes and line of credit. Interest expense in 2009 includes $2.8 million for our lease financing

obligations, $2.6 million of interest payments due on our notes and $1.1 million of amortization of debt issuance

costs.

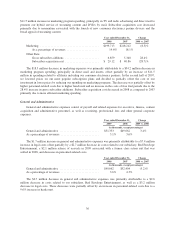

Year ended December 31, Change

2008 2007 2008 vs. 2007

(in thousands, except percentages)

Interest Expense ................................... $2,458 $1,188 106.9%

As a percentage of revenues .......................... 0.2% 0.1%

The $1.3 million increase in interest expense is due to an increase in the interest on our lease financing

obligations arising when the lease term for the second of our headquarter buildings commenced.

Interest and Other Income (Expense)

Interest and other income (expense) consist primarily of interest and dividend income generated from

invested cash and short-term investments.

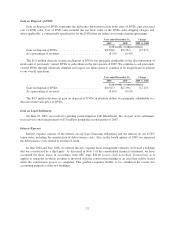

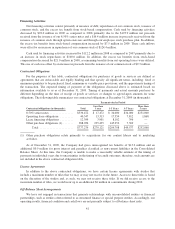

Year ended December 31, Change

2009 2008 2009 vs. 2008

(in thousands, except percentages)

Interest and other income (expense) .................... $6,728 $12,452 (46.0)%

As a percentage of revenues .......................... 0.4% 0.9%

The $5.7 million decrease in interest and other income was primarily attributable to lower cash and

investment balances resulting from the repurchase of our common stock, and a $1.6 million decrease in realized

gains recognized as compared to the prior year. The decrease was offset by a $1.8 million dollar gain realized in

2009 on the sale of our investment in a private company which we accounted for under the cost method.

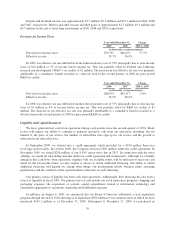

Year ended December 31, Change

2008 2007 2008 vs. 2007

(in thousands, except percentages)

Interest and other income (expense) .................... $12,452 $20,340 (38.8)%

As a percentage of revenues .......................... 0.9% 1.7%

The $7.9 million decrease in interest and other income was primarily a result of the lower cash and

investment balances resulting from the repurchase of our common stock. The decrease was offset by a $2.4

million increase in realized gains.

38