NetFlix 2009 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2009 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NETFLIX, INC.

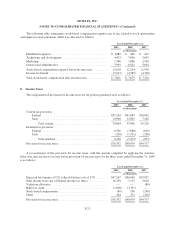

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

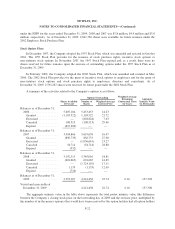

On April 17, 2007, the Company’s Board of Directors authorized a stock repurchase program allowing the

Company to repurchase up to $100.0 million of its common stock through the end of 2007. During the year

ended December 31, 2007, the Company repurchased 4,733,788 shares of common stock at an average price of

approximately $21 per share for an aggregate amount of $100 million. Shares repurchased under this program

have been retired.

In the fourth quarter of 2009, the Company determined that all shares held in treasury stock would be

retired. Accordingly, these constructively retired shares were deducted from common stock for par value and

from additional paid in capital for the excess over par value, until additional paid in capital was exhausted and

then from retained earnings.

There were no unsettled share repurchases as of December 31, 2009.

Preferred Stock

The Company has authorized 10,000,000 shares of undesignated preferred stock with par value of $0.001

per share. None of the preferred shares were issued and outstanding at December 31, 2009 and 2008.

Voting Rights

The holders of each share of common stock shall be entitled to one vote per share on all matters to be voted

upon by the Company’s stockholders.

Employee Stock Purchase Plan

In February 2002, the Company adopted the 2002 Employee Stock Purchase Plan (“ESPP”), which reserved

a total of 1,166,666 shares of common stock for issuance. The 2002 Employee Stock Purchase Plan also provides

for annual increases in the number of shares available for issuance on the first day of each year, beginning with

2003, equal to the lesser of:

• 2% of the outstanding shares of the common stock on the first day of the applicable year;

• 666,666 shares; and

• such other amount as the Company’s Board of Directors may determine.

Under the Company’s ESPP, employees may purchase common stock of the Company through accumulated

payroll deductions. The purchase price of the common stock acquired by the employees participating in the ESPP

is 85% of the closing price on either the first day of the offering period or the last day of the purchase period,

whichever is lower. Through May 1, 2006, offering periods were twenty-four months, and the purchase periods

were six months. Therefore, each offering period included four six-month purchase periods, and the purchase

price for each six-month period was determined by comparing the closing prices on the first day of the offering

period and the last day of the applicable purchase period. In this manner, the look-back for determining the

purchase price was up to twenty-four months. However, effective May 1, 2006, the ESPP was amended so that

offering and purchase periods take place concurrently in consecutive six month increments. Under the amended

ESPP, therefore, the look-back for determining the purchase price is six months. Employees may invest up to

15% of their gross compensation through payroll deductions. In no event shall an employee be permitted to

purchase more than 8,334 shares of common stock during any six-month purchase period. During the years

ended December 31, 2009, 2008 and 2007, employees purchased approximately 224,799, 231,068 and 205,416

shares at average prices of $25.65, $21.00 and $18.43 per share, respectively. Cash received from purchases

F-21