NetFlix 2009 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2009 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NETFLIX, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Restricted cash of $2.8 million and $1.9 million, as of December 31, 2009 and 2008, respectively, related to

workers’ compensation insurance deposits.

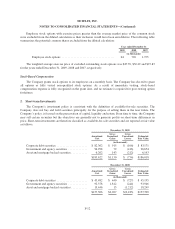

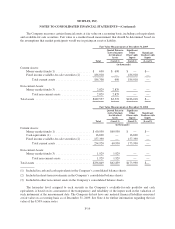

Accrued Expenses

Accrued expenses consisted of the following:

As of December 31,

2009 2008

(in thousands)

Accrued state sales and use tax ............................... $11,625 $ 9,127

Accrued payroll and employee benefits ........................ 6,427 5,956

Accrued settlement costs .................................... — 2,409

Accrued interest on debt .................................... 2,597 —

Accrued content acquisition costs ............................. 5,810 6,237

Other ................................................... 6,928 7,665

Total accrued expenses ..................................... $33,387 $31,394

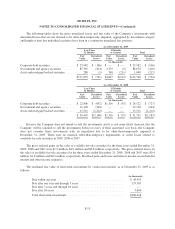

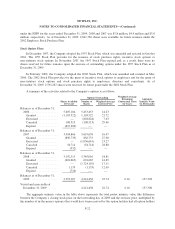

4. Long-term Debt

Senior Notes

In November 2009, the Company issued $200.0 million aggregate principal amount of 8.50% senior notes

due November 15, 2017 (the “8.50% Notes”). The net proceeds to the Company from the 8.50% Notes were

approximately $193.9 million. Debt issuance costs of $6.1 million are recorded in other assets on the

consolidated balance sheet and are amortized over the term of the notes as interest expense. The notes were

issued at par and are senior unsecured obligations of the Company. Interest is payable semi-annually at a rate of

8.50% per annum on May 15 and November 15 of each year, commencing on May 15, 2010. The 8.50% Notes

are repayable in whole or in part upon the occurrence of a change of control, at the option of the holders, at a

purchase price in cash equal to 101% of the principal plus accrued interest. Prior to November 15, 2012, in the

event of a qualified equity offering, the Company may redeem up to 35% of the 8.50% Notes at a redemption

price of 108.50% of the principal plus accrued interest. Additionally, the Company may redeem the 8.50% Notes

prior to November 15, 2013 in whole or in part at a redemption price of 100% of the principal plus accrued

interest, plus a “make-whole” premium. On or after November 15, 2013, the Company may redeem the

8.50% Notes in whole or in part at specified prices ranging from 104.25% to 100% of the principal plus accrued

interest.

The 8.50% Notes include, among other terms and conditions, limitations on the Company’s ability to create,

incur, assume or be liable for indebtedness (other than specified types of permitted indebtedness); dispose of

assets outside the ordinary course (subject to specified exceptions); acquire, merge or consolidate with or into

another person or entity (other than specified types of permitted acquisitions); create, incur or allow any lien on

any of its property or assign any right to receive income (except for specified permitted liens); make investments

(other than specified types of investments); or pay dividends or make distributions (each subject to specified

exceptions). At December 31, 2009, the Company was in compliance with these covenants.

Based on quoted market prices, the fair value of the 8.50% Notes was approximately $207.5 million as of

December 31, 2009.

F-16