NetFlix 2009 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2009 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

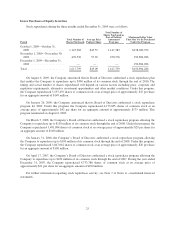

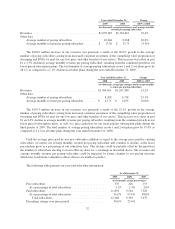

Performance Highlights

The following represents our performance highlights for 2009, 2008 and 2007 (in thousands, except for per

share amounts, percentages and subscriber acquisition costs):

2009 2008 2007

Revenues ....................................... $1,670,269 $1,364,661 $1,205,340

Net income ..................................... 115,860 83,026 66,608

Net income per share—diluted ...................... $ 1.98 $ 1.32 $ 0.97

Total subscribers at end of period .................... 12,268 9,390 7,479

Churn (annualized) (1) ............................ 4.2% 4.2% 4.3%

Subscriber acquisition cost ......................... $ 25.48 $ 29.12 $ 40.86

Gross margin .................................... 35.4% 33.3% 34.8%

(1) Churn is a monthly measure defined as customer cancellations in the quarter divided by the sum of

beginning subscribers and gross subscriber addition, then divided by three months. Churn (annualized) is the

average of Churn for the four quarters of each respective year.

Critical Accounting Policies and Estimates

The preparation of consolidated financial statements in conformity with accounting principles generally

accepted in the United States requires management to make estimates and assumptions that affect the reported

amounts of assets and liabilities, disclosures of contingent assets and liabilities at the date of the financial

statements, and the reported amounts of revenues and expenses during the reported periods. The Securities and

Exchange Commission (“SEC”) has defined a company’s critical accounting policies as the ones that are most

important to the portrayal of a company’s financial condition and results of operations, and which require a

company to make its most difficult and subjective judgments. Based on this definition, we have identified the

critical accounting policies and judgments addressed below. We base our estimates on historical experience and

on various other assumptions that the Company believes to be reasonable under the circumstances. Actual results

may differ from these estimates.

Content Accounting

We obtain content through direct purchases, revenue sharing agreements and license agreements with

studios, distributors, and other suppliers. DVD content is obtained through direct purchases or revenue sharing

agreements. Streaming content is generally licensed for a fixed fee for the term of the license agreement but may

also be obtained through a revenue sharing agreement.

We acquire DVD content for the purpose of rental to our subscribers and earning subscription rental

revenues, and, as such, we consider our direct purchase DVD library to be a productive asset. Accordingly, we

classify our DVD library as a non-current asset on our consolidated balance sheets. Additionally, cash outflows

for the acquisition of the DVD library, net of changes in related accounts payable, are classified as cash flows

from investing activities on our consolidated statements of cash flows. This is inclusive of any upfront

non-refundable payments required under revenue sharing agreements.

We amortize our direct purchase DVDs, less estimated salvage value, on a “sum-of-the-months” accelerated

basis over their estimated useful lives. The useful life of the new-release DVDs and back-catalog DVDs is

estimated to be one year and three years, respectively. In estimating the useful life of our DVDs, we take into

account library utilization as well as an estimate for lost or damaged DVDs. For those direct purchase DVDs that

we estimate we will sell at the end of their useful lives, a salvage value is provided. For those DVDs that we do

not expect to sell, no salvage value is provided. We periodically evaluate the useful lives and salvage values of

our DVDs.

28