NetFlix 2009 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2009 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

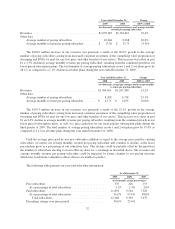

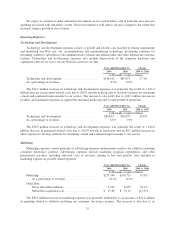

Gain on Disposal of DVDs

Gain on disposal of DVDs represents the difference between proceeds from sales of DVDs and associated

cost of DVD sales. Cost of DVD sales includes the net book value of the DVDs sold, shipping charges and,

where applicable, a contractually specified fee for the DVDs that are subject to revenue sharing agreements.

Year ended December 31, Change

2009 2008 2009 vs. 2008

(in thousands, except percentages)

Gain on disposal of DVDs ........................... $(4,560) $(6,327) (27.9)%

As a percentage of revenues .......................... (0.3)% (0.4)%

The $1.8 million decrease in gain on disposal of DVDs was primarily attributable to the discontinuation of

retail sales of previously viewed DVDs to subscribers in the first quarter of 2009. We continue to sell previously

viewed DVDs through wholesale channels and expect our future gains to continue to be insignificant in relation

to our overall operations.

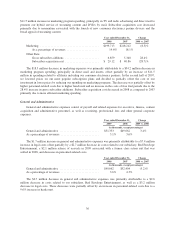

Year ended December 31, Change

2008 2007 2008 vs. 2007

(in thousands, except percentages)

Gain on disposal of DVDs ........................... $(6,327) $(7,196) (12.1)%

As a percentage of revenues .......................... (0.4)% (0.5)%

The $0.9 million decrease in gain on disposal of DVDs in absolute dollars was primarily attributable to a

decrease in the sales price of DVDs.

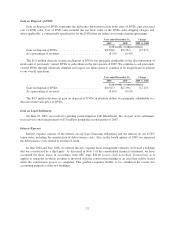

Gain on Legal Settlement

On June 25, 2007, we resolved a pending patent litigation with Blockbuster, Inc. As part of the settlement,

we received a one-time payment of $7.0 million during the second quarter of 2007.

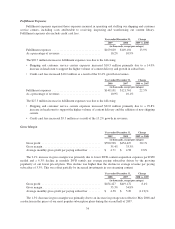

Interest Expense

Interest expense consists of the interest on our lease financing obligations and the interest on our 8.50%

senior notes including the amortization of debt issuance costs. Also, in the fourth quarter of 2009, we expensed

the debt issuance costs related to our line of credit.

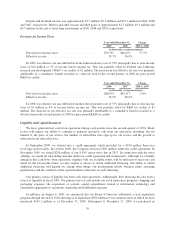

In June 2004 and June 2006, we entered into two separate lease arrangements whereby we leased a building

that was constructed by a third party. As discussed in Note 5 of the consolidated financial statements, we have

accounted for these leases in accordance with ASC topic 840.40 Leases—Sale-Leaseback Transactions as it

applies to situations in which an entity is involved with the construction funding of an asset that will be leased

when the construction project is completed. This guidance requires Netflix to be considered the owner (for

accounting purposes) of the two buildings.

37