NetFlix 2009 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2009 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

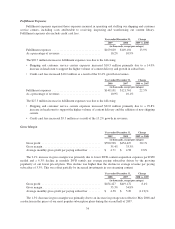

Financing Activities

Our financing activities consist primarily of issuance of debt, repurchases of our common stock, issuance of

common stock, and the excess tax benefit from stock-based compensation. Cash used by financing activities

decreased by $92.0 million in 2009 as compared to 2008 primarily due to the $193.9 million net proceeds

received from the issuance of our 8.50% senior notes and a $16.4 million increase in proceeds received from the

issuance of common stock through option exercises and through our employee stock purchase plan. In addition,

the excess tax benefits from stock-based compensation increased by $7.5 million in 2009. These cash inflows

were offset by an increase in repurchases of our common stock of $124.4 million.

Cash used by financing activities increased by $112.2 million in 2008 as compared to 2007 primarily due to

an increase in stock repurchases of $100.0 million. In addition, the excess tax benefits from stock-based

compensation decreased by $21.0 million in 2008, as remaining benefits from net operating losses were utilized.

This use of cash was offset by an increase in proceeds from the issuance of our common stock of $9.3 million.

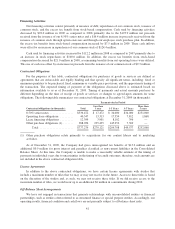

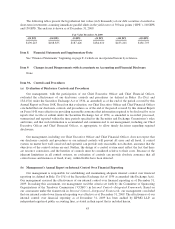

Contractual Obligations

For the purposes of this table, contractual obligations for purchases of goods or services are defined as

agreements that are enforceable and legally binding and that specify all significant terms, including: fixed or

minimum quantities to be purchased; fixed, minimum or variable price provisions; and the approximate timing of

the transaction. The expected timing of payment of the obligations discussed above is estimated based on

information available to us as of December 31, 2009. Timing of payments and actual amounts paid may be

different depending on the time of receipt of goods or services or changes to agreed-upon amounts for some

obligations. The following table summarizes our contractual obligations at December 31, 2009 (in thousands):

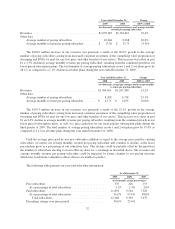

Payments due by Period

Contractual obligations (in thousands): Total

Less than

1 year 1-3 Years 3-5 Years

More than

5 years

8.50% senior notes ................ $336,472 $ 17,472 $ 34,000 $34,000 $251,000

Operating lease obligations ......... 40,347 13,313 17,354 7,812 1,868

Lease financing obligations ......... 12,399 3,901 8,102 396 —

Other purchase obligations (1) ....... 388,056 235,435 145,252 7,369 —

Total ....................... $777,274 $270,121 $204,708 $49,577 $252,868

(1) Other purchase obligations relate primarily to acquisitions for our content library and to marketing

activities.

As of December 31, 2009, the Company had gross unrecognized tax benefits of $13.2 million and an

additional $0.9 million for gross interest and penalties classified as non-current liabilities in the Consolidated

Balance Sheet. At this time, the Company is unable to make a reasonably reliable estimate of the timing of

payments in individual years due to uncertainties in the timing of tax audit outcomes; therefore, such amounts are

not included in the above contractual obligation table.

License Agreements

In addition to the above contractual obligations, we have certain license agreements with studios that

include a maximum number of titles that we may or may not receive in the future. Access to these titles is based

on the discretion of the studios and, as such, we may not receive these titles. If we did receive access to the

maximum number of titles, we would incur up to an additional $6 million in commitments during 2010.

Off-Balance Sheet Arrangements

We have not engaged in transactions that generate relationships with unconsolidated entities or financial

partnerships, such as entities often referred to as structured finance or special purpose entities. Accordingly, our

operating results, financial condition and cash flows are not presently subject to off-balance sheet risks.

41