Macy's 2014 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2014 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

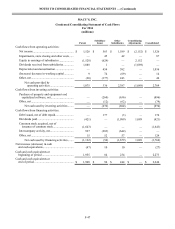

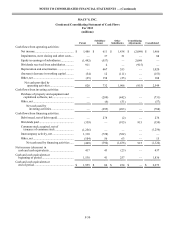

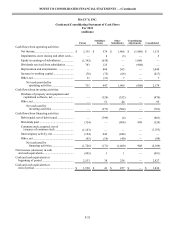

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

F-50

MACY’S, INC.

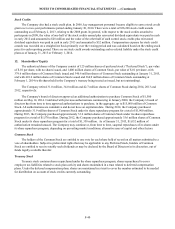

Condensed Consolidating Statement of Cash Flows

For 2013

(millions)

Parent Subsidiary

Issuer Other

Subsidiaries Consolidating

Adjustments Consolidated

Cash flows from operating activities:

Net income..................................................... $ 1,486 $ 611 $ 1,438 $ (2,049) $ 1,486

Impairments, store closing and other costs.... — 37 51 — 88

Equity in earnings of subsidiaries.................. (1,492) (557) — 2,049 —

Dividends received from subsidiaries ........... 911 4 — (915) —

Depreciation and amortization ...................... — 467 553 — 1,020

(Increase) decrease in working capital .......... (54) 12 (111) — (153)

Other, net....................................................... (25) 158 (25) — 108

Net cash provided by

operating activities................................ 826 732 1,906 (915) 2,549

Cash flows from investing activities:

Purchase of property and equipment and

capitalized software, net............................. —(289)(442) — (731)

Other, net....................................................... —(6)(51) — (57)

Net cash used by

investing activities .............................. —(295)(493) — (788)

Cash flows from financing activities:

Debt issued, net of debt repaid ...................... — 278 (2) — 276

Dividends paid............................................... (359) — (915) 915 (359)

Common stock acquired, net of

issuance of common stock ......................... (1,256) — — — (1,256)

Intercompany activity, net............................. 1,310 (728)(582) — —

Other, net....................................................... (104) 56 63 — 15

Net cash used by financing activities..... (409) (394)(1,436) 915 (1,324)

Net increase (decrease) in

cash and cash equivalents ................................. 417 43 (23) — 437

Cash and cash equivalents at

beginning of period........................................... 1,538 41 257 — 1,836

Cash and cash equivalents at

end of period ..................................................... $ 1,955 $ 84 $ 234 $ — $ 2,273