Macy's 2014 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2014 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

F-14

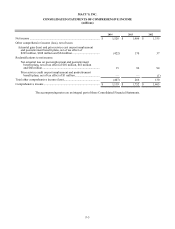

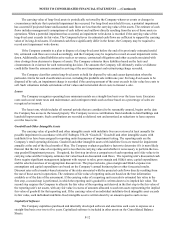

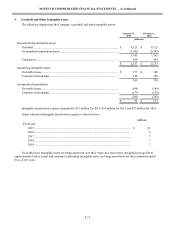

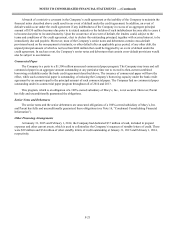

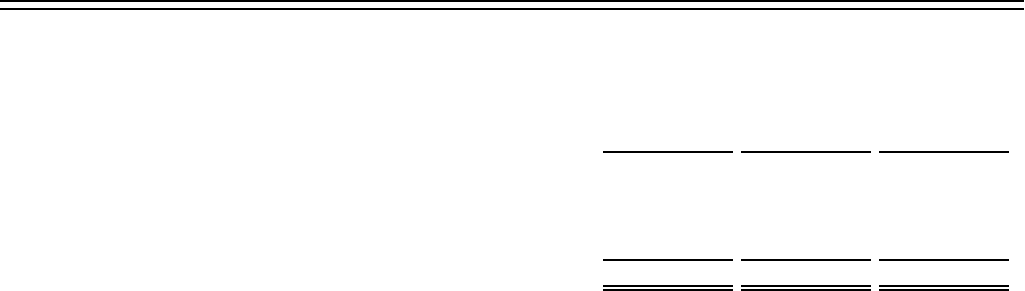

2. Impairments, Store Closing and Other Costs

Impairments, store closing and other costs consist of the following:

2014 2013 2012

(millions)

Impairments of properties held and used ................................................. $ 33 $ 39 $ 4

Severance ................................................................................................. 46 43 3

Other......................................................................................................... 8 6 (2)

$ 87 $ 88 $ 5

During January 2015, the Company announced a series of initiatives to evolve its business model and invest in

continued growth opportunities, including a restructuring of merchandising and marketing functions at Macy's and

Bloomingdale's consistent with the Company's omnichannel approach to retailing, as well as a series of adjustments to its

field and store operations to increase productivity and efficiency.

During January 2014, the Company announced a series of cost-reduction initiatives, including organization changes

that combine certain region and district organizations of the My Macy’s store management structure and the realignment

and elimination of certain store, central office and administrative functions.

During January 2015, the Company announced the closure of fourteen Macy's stores; during January 2014, the

Company announced the closure of five Macy's stores; and during January 2013, the Company announced the closure of

six Macy’s and Bloomingdale's stores.

In connection with these announcements and the plans to dispose of these locations, the Company incurred severance

and other human resource-related costs and other costs related to lease obligations and other store liabilities.

As a result of the Company’s projected undiscounted future cash flows related to certain store locations and other

assets being less than their carrying value, the Company recorded impairment charges, including properties that were the

subject of announced store closings. The fair values of these assets were calculated based on the projected cash flows and

an estimated risk-adjusted rate of return that would be used by market participants in valuing these assets or based on

prices of similar assets.

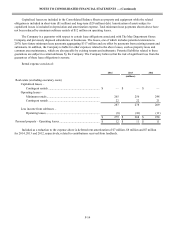

The Company expects to pay out the 2014 accrued severance costs, which are included in accounts payable and

accrued liabilities on the Consolidated Balance Sheets, prior to May 2, 2015. The 2013 and 2012 accrued severance costs,

which were included in accounts payable and accrued liabilities on the Consolidated Balance Sheets, were paid out in the

fiscal year subsequent to incurring such severance costs.

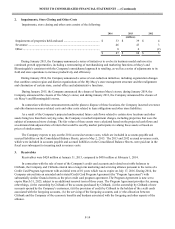

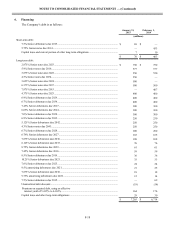

3. Receivables

Receivables were $424 million at January 31, 2015, compared to $438 million at February 1, 2014.

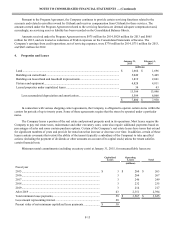

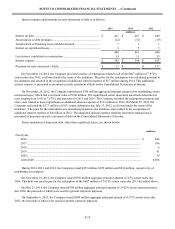

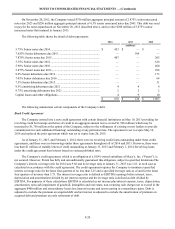

In connection with the sale of most of the Company's credit card accounts and related receivable balances to

Citibank, the Company and Citibank entered into a long-term marketing and servicing alliance pursuant to the terms of a

Credit Card Program Agreement with an initial term of 10 years which was to expire on July 17, 2016. During 2014, the

Company entered into an amended and restated Credit Card Program Agreement (the “Program Agreement”) with

substantially similar financial terms as the prior credit card program agreement. The Program Agreement is now set to

expire March 31, 2025, subject to an additional renewal term of three years. The Program Agreement provides for, among

other things, (i) the ownership by Citibank of the accounts purchased by Citibank, (ii) the ownership by Citibank of new

accounts opened by the Company’s customers, (iii) the provision of credit by Citibank to the holders of the credit cards

associated with the foregoing accounts, (iv) the servicing of the foregoing accounts, and (v) the allocation between

Citibank and the Company of the economic benefits and burdens associated with the foregoing and other aspects of the

alliance.