Macy's 2014 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2014 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

F-39

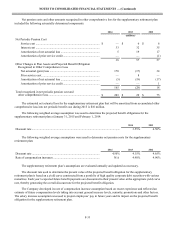

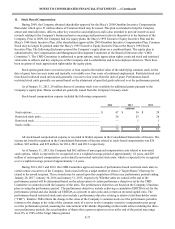

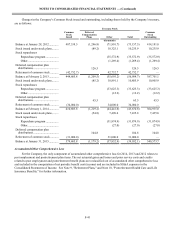

Restricted Stock and Restricted Stock Units

The weighted average grant date fair values of restricted stock units granted during 2014, 2013 and 2012 are as

follows:

2014 2013 2012

Restricted stock units ............................................................................... $ 59.41 $ 42.54 $ 39.52

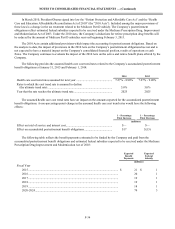

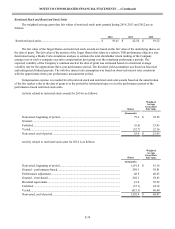

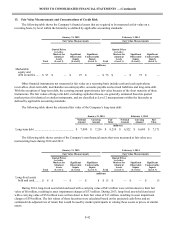

The fair value of the Target Shares and restricted stock awards are based on the fair value of the underlying shares on

the date of grant. The fair value of the portion of the Target Shares that relate to a relative TSR performance objective was

determined using a Monte Carlo simulation analysis to estimate the total shareholder return ranking of the Company

among a ten-or twelve-company executive compensation peer group over the remaining performance periods. The

expected volatility of the Company’s common stock at the date of grant was estimated based on a historical average

volatility rate for the approximate three-year performance period. The dividend yield assumption was based on historical

and anticipated dividend payouts. The risk-free interest rate assumption was based on observed interest rates consistent

with the approximate three-year performance measurement period.

Compensation expense is recorded for all restricted stock and restricted stock unit awards based on the amortization

of the fair market value at the date of grant over the period the restrictions lapse or over the performance period of the

performance-based restricted stock units.

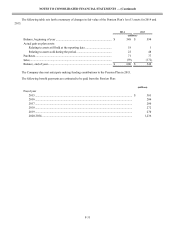

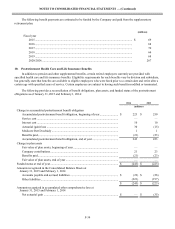

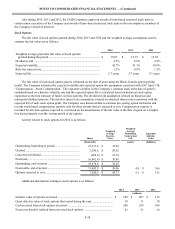

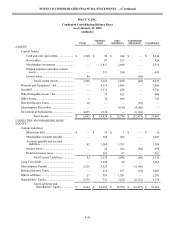

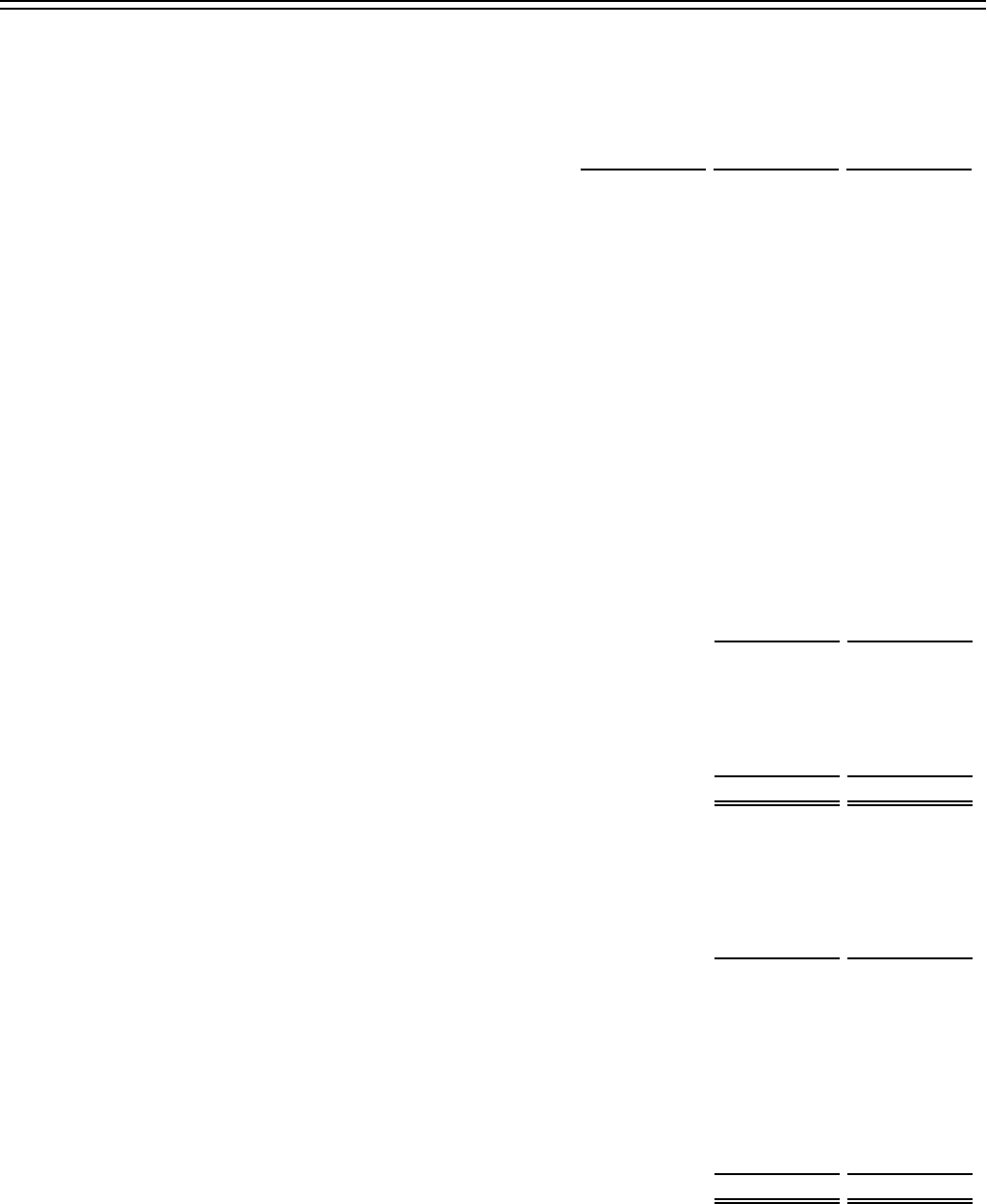

Activity related to restricted stock awards for 2014 is as follows:

Shares

Weighted

Average

Grant Date

Fair Value

(thousands)

Nonvested, beginning of period.................................................................................. 79.2 $ 22.58

Granted........................................................................................................................ — —

Forfeited...................................................................................................................... (0.6) 23.43

Vested.......................................................................................................................... (52.7) 22.16

Nonvested, end of period ............................................................................................ 25.9 $ 23.43

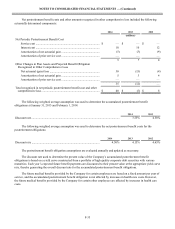

Activity related to restricted stock units for 2014 is as follows:

Shares

Weighted

Average

Grant Date

Fair Value

(thousands)

Nonvested, beginning of period.................................................................................. 1,191.8 $ 41.16

Granted – performance-based ..................................................................................... 289.3 59.81

Performance adjustment.............................................................................................. 46.9 40.63

Granted – time-based .................................................................................................. 202.3 58.83

Dividend equivalents................................................................................................... 21.0 59.52

Forfeited...................................................................................................................... (37.1) 42.12

Vested.......................................................................................................................... (421.3) 40.40

Nonvested, end of period ............................................................................................ 1,292.9 $ 48.47