Macy's 2014 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2014 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.25

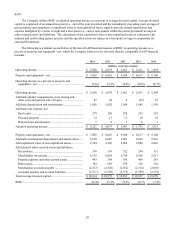

Liquidity and Capital Resources

The Company's principal sources of liquidity are cash from operations, cash on hand and the credit facility described

below.

Operating Activities

Net cash provided by operating activities was $2,709 million in 2014 compared to $2,549 million in 2013, reflecting

higher net income and a decrease in merchandise inventories and merchandise accounts payable in 2014 compared to an

increase in merchandise inventories and merchandise accounts payable in 2013, reflecting improved inventory turnover.

Investing Activities

Net cash used by investing activities for 2014 was $970 million, compared to net cash used by investing activities of

$788 million for 2013. Investing activities for 2014 includes purchases of property and equipment totaling $770 million

and capitalized software of $298 million, compared to purchases of property and equipment totaling $607 million and

capitalized software of $256 million for 2013. Cash flows from investing activities included $172 million and $132 million

from the disposition of property and equipment for 2014 and 2013, respectively. At January 31, 2015, the Company had

approximately $98 million of cash in a qualified escrow account, included in prepaid expenses and other current assets, to

be utilized for potential tax deferred like-kind exchange transactions.

During 2014, the Company opened three new Macy's stores, one Bloomingdale's replacement store, and one new

Bloomingdale's furniture clearance store. During 2013, the Company opened three new Macy's stores, one Macy's

replacement store, one new Bloomingdale's store and one new Bloomingdale's Outlet store.

On March 9, 2015, the Company completed its acquisition of Bluemercury, Inc., a luxury beauty products and spa

retailer, for approximately $210 million in cash. The Company is focused on accelerating the growth of sales in self-

standing Bluemercury stores in urban and suburban markets, enhancing its online capabilities and adding selected

Bluemercury products and boutiques to Macy's stores nationwide.

Financing Activities

Net cash used by the Company for financing activities was $1,766 million for 2014, including the acquisition of the

Company's common stock under its share repurchase program at an approximate cost of $1,900 million, the repayment of

$870 million of debt and the payment of $421 million of cash dividends, partially offset by the issuance of $1,050 million

of debt, the issuance of $258 million of common stock, primarily related to the exercise of stock options, and an increase in

outstanding checks of $133 million. $550 million aggregate principal amount of 4.5% senior notes due 2034 and $500

million aggregate principal amount of 3.625% senior unsecured notes due 2024 were issued in 2014.

On November 14, 2014, the Company provided a notice of redemption related to all of the $407 million of 7.875%

senior notes due 2015, as allowed under the terms of the indenture. The price for the redemption was calculated pursuant to

the indenture and resulted in the recognition of additional interest expense of $17 million during 2014. This additional

interest expense is presented as premium on early retirement of debt on the Consolidated Statements of Income. Debt

repaid during 2014 also included $453 million of 5.75% senior notes due July 15, 2014 paid at maturity.

Net cash used by the Company for financing activities was $1,324 million for 2013 and included the acquisition of

the Company's common stock under its share repurchase program at an approximate cost of $1,570 million, the repayment

of $124 million of debt and the payment of $359 million of cash dividends, partially offset by the issuance of $400 million

of debt, the issuance of $315 million of common stock, primarily related to the exercise of stock options, and an increase in

outstanding checks of $24 million. $400 million of 4.375% senior notes due 2023 were issued in 2013 and the debt repaid

during 2013 included $109 million of 7.625% senior debentures due August 15, 2013 paid at maturity.

The Company entered into a new credit agreement with certain financial institutions on May 10, 2013 providing for

revolving credit borrowings and letters of credit in an aggregate amount not to exceed $1,500 million (which may be

increased to $1,750 million at the option of the Company, subject to the willingness of existing or new lenders to provide

commitments for such additional financing) outstanding at any particular time. The agreement is set to expire May 10,

2018 and replaced the prior agreement which was set to expire June 20, 2015. As of January 31, 2015 and throughout all of

2014, the Company had no borrowings outstanding under its credit agreement.