Macy's 2014 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2014 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.31

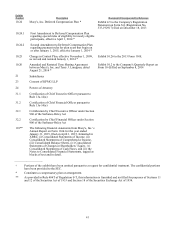

Item 7A. Quantitative and Qualitative Disclosures About Market Risk.

The Company is exposed to market risk from changes in interest rates that may adversely affect its financial position,

results of operations and cash flows. In seeking to minimize the risks from interest rate fluctuations, the Company manages

exposures through its regular operating and financing activities and, when deemed appropriate, through the use of

derivative financial instruments. The Company does not use financial instruments for trading or other speculative purposes

and is not a party to any leveraged financial instruments.

The Company is exposed to interest rate risk through its borrowing activities, which are described in Note 6 to the

Consolidated Financial Statements. All of the Company’s borrowings are under fixed rate instruments. However, the

Company, from time to time, may use interest rate swap and interest rate cap agreements to help manage its exposure to

interest rate movements and reduce borrowing costs. At January 31, 2015, the Company was not a party to any derivative

financial instruments and based on the Company’s lack of market risk sensitive instruments outstanding at January 31,

2015, the Company has determined that there was no material market risk exposure to the Company’s consolidated

financial position, results of operations or cash flows as of such date.

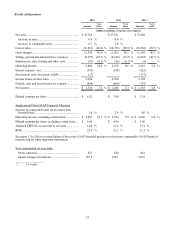

Item 8. Consolidated Financial Statements and Supplementary Data.

Information called for by this item is set forth in the Company’s Consolidated Financial Statements and

supplementary data contained in this report and is incorporated herein by this reference. Specific financial statements and

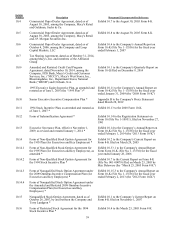

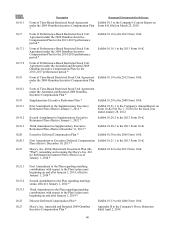

supplementary data can be found at the pages listed in the following index: