Macy's 2014 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2014 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.24

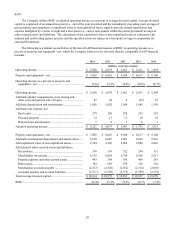

Impairments, Store Closing and Other Costs

Impairments, store closing and other costs for 2013 included costs and expenses primarily associated with cost-

reduction initiatives and store closings announced in January 2014. During 2013, these costs and expenses included $43

million of severance and other human resource-related costs and asset impairment charges of $39 million. Impairments,

store closing and other costs for 2012 included $4 million of asset impairment charges primarily related to the store

closings announced in January 2013.

Net Interest Expense

Net interest expense for 2013 decreased $34 million from 2012. Net interest expense for 2013 benefited from lower

rates on outstanding borrowings as compared to 2012.

Premium on Early Retirement of Debt

On November 28, 2012, the Company repurchased $700 million aggregate principal amount of its outstanding senior

unsecured notes, which had a net book value of $706 million. The repurchased senior unsecured notes had stated interest

rates ranging from 5.9% to 7.875% and maturities in 2015 and 2016. The Company recorded the redemption premium and

other costs related to these repurchases as additional interest expense of $133 million in 2012. On March 29, 2012, the

Company redeemed the $173 million of 8.0% senior debentures due July 15, 2012, as allowed under the terms of the

indenture. The price for the redemption was calculated pursuant to the indenture and resulted in the recognition of

additional interest expense of $4 million in 2012. The additional interest expense resulting from these transactions was

presented as premium on early retirement of debt on the Consolidated Statements of Income.

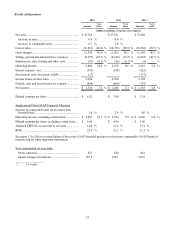

Effective Tax Rate

The Company's effective tax rate of 35.1% for 2013 and 36.5% for 2012 differ from the federal income tax statutory

rate of 35%, and on a comparative basis, principally because of the effect of state and local income taxes, including the

settlement of various tax issues and tax examinations. Additionally, income tax expense for 2013 benefited from historic

rehabilitation tax credits and a reduction in the valuation allowance related primarily to state net operating loss

carryforwards.

Guidance

Based on its assessment of current and anticipated market conditions and its recent performance, the Company's 2015

assumptions include:

• Total sales growth of approximately 1% from 2014 levels;

• Comparable sales increase on an owned basis, as well as on an owned plus licensed basis, of approximately 2%

from 2014 levels;

• Diluted earnings per share of $4.70 to $4.80; and

• Capital expenditures of approximately $1,200 million.

• The acquisition of Bluemercury, Inc. for approximately $210 million in cash.

The Company's budgeted capital expenditures are primarily related to new stores, store remodels, maintenance, the

continued renovation of Macy's Herald Square, technology and omnichannel investments, distribution network

improvements, including a new direct to customer fulfillment center in Tulsa County, OK, and new growth initiatives. The

Company has announced that in 2015 it intends to open a new Macy's store in Ponce, Puerto Rico, a new Bloomingdale's

store in Honolulu, HI, in 2016 it intends to open a new Macy's store in Kapolei, HI and a Macy's replacement store in Los

Angeles, CA, in 2017 it intends to open a new Macy's store in Miami, FL, and new Bloomingdale's stores in Miami, FL

and San Jose, CA, and in 2018 it intends to open a new Bloomingdale's store in Norwalk, CT. Management presently

anticipates funding such expenditures with cash on hand and cash from operations.