Macy's 2014 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2014 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

F-19

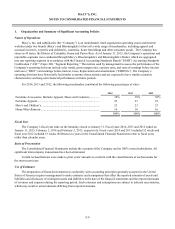

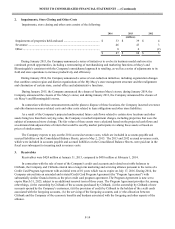

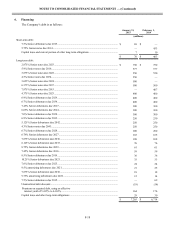

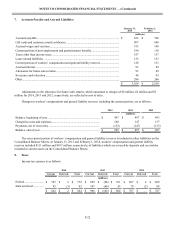

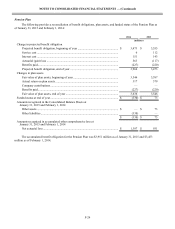

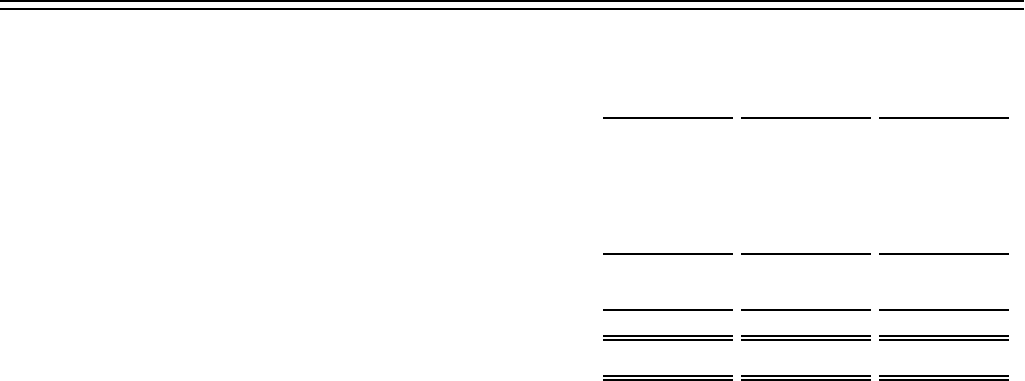

Interest expense and premium on early retirement of debt is as follows:

2014 2013 2012

(millions)

Interest on debt......................................................................................... $ 411 $ 407 $ 449

Amortization of debt premium................................................................. (12)(15)(19)

Amortization of financing costs and debt discount.................................. 7 7 7

Interest on capitalized leases.................................................................... 2 2 3

408 401 440

Less interest capitalized on construction.................................................. 13 11 15

Interest expense........................................................................................ $ 395 $ 390 $ 425

Premium on early retirement of debt........................................................ $ 17 $ — $ 137

On November 14, 2014, the Company provided a notice of redemption related to all of the $407 million of 7.875%

senior notes due 2015, as allowed under the terms of the indenture. The price for the redemption was calculated pursuant to

the indenture and resulted in the recognition of additional interest expense of $17 million during 2014. This additional

interest expense is presented as premium on early retirement of debt on the Consolidated Statements of Income.

On November 28, 2012, the Company repurchased $700 million aggregate principal amount of its outstanding senior

unsecured notes, which had a net book value of $706 million. The repurchased senior unsecured notes had stated interest

rates ranging from 5.9% to 7.875% and maturities in 2015 and 2016. The Company recorded the redemption premium and

other costs related to these repurchases as additional interest expense of $133 million in 2012. On March 29, 2012, the

Company redeemed the $173 million of 8.0% senior debentures due July 15, 2012, as allowed under the terms of the

indenture. The price for the redemption was calculated pursuant to the indenture and resulted in the recognition of

additional interest expense of $4 million in 2012. The additional interest expense resulting from these transactions is

presented as premium on early retirement of debt on the Consolidated Statements of Income.

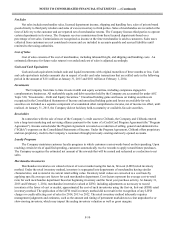

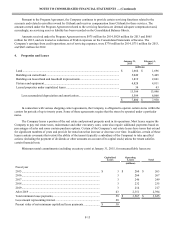

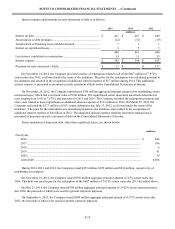

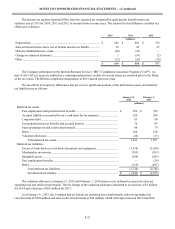

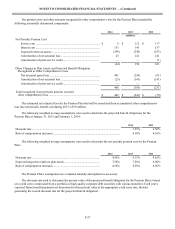

Future maturities of long-term debt, other than capitalized leases, are shown below:

(millions)

Fiscal year

2016.......................................................................................................................................................... $ 642

2017.......................................................................................................................................................... 306

2018.......................................................................................................................................................... 6

2019.......................................................................................................................................................... 41

2020.......................................................................................................................................................... 39

After 2020 ................................................................................................................................................ 6,056

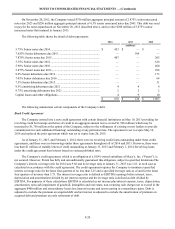

During 2014, 2013 and 2012, the Company repaid $453 million, $109 million and $914 million, respectively, of

indebtedness at maturity.

On November 18, 2014, the Company issued $550 million aggregate principal amount of 4.5% senior notes due

2034. This debt was used to pay for the redemption of the $407 million of 7.875% senior notes due 2015 described above.

On May 23, 2014, the Company issued $500 million aggregate principal amount of 3.625% senior unsecured notes

due 2024, the proceeds of which were used for general corporate purposes.

On September 6, 2013, the Company issued $400 million aggregate principal amount of 4.375% senior notes due

2023, the proceeds of which were used for general corporate purposes.