Macy's 2014 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2014 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

F-23

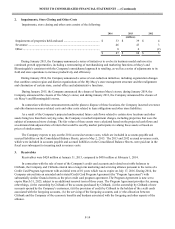

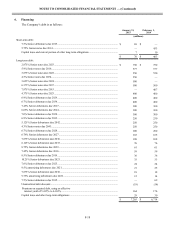

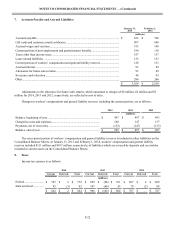

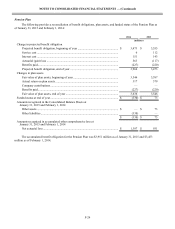

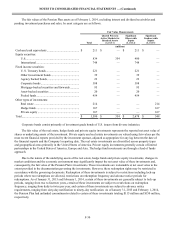

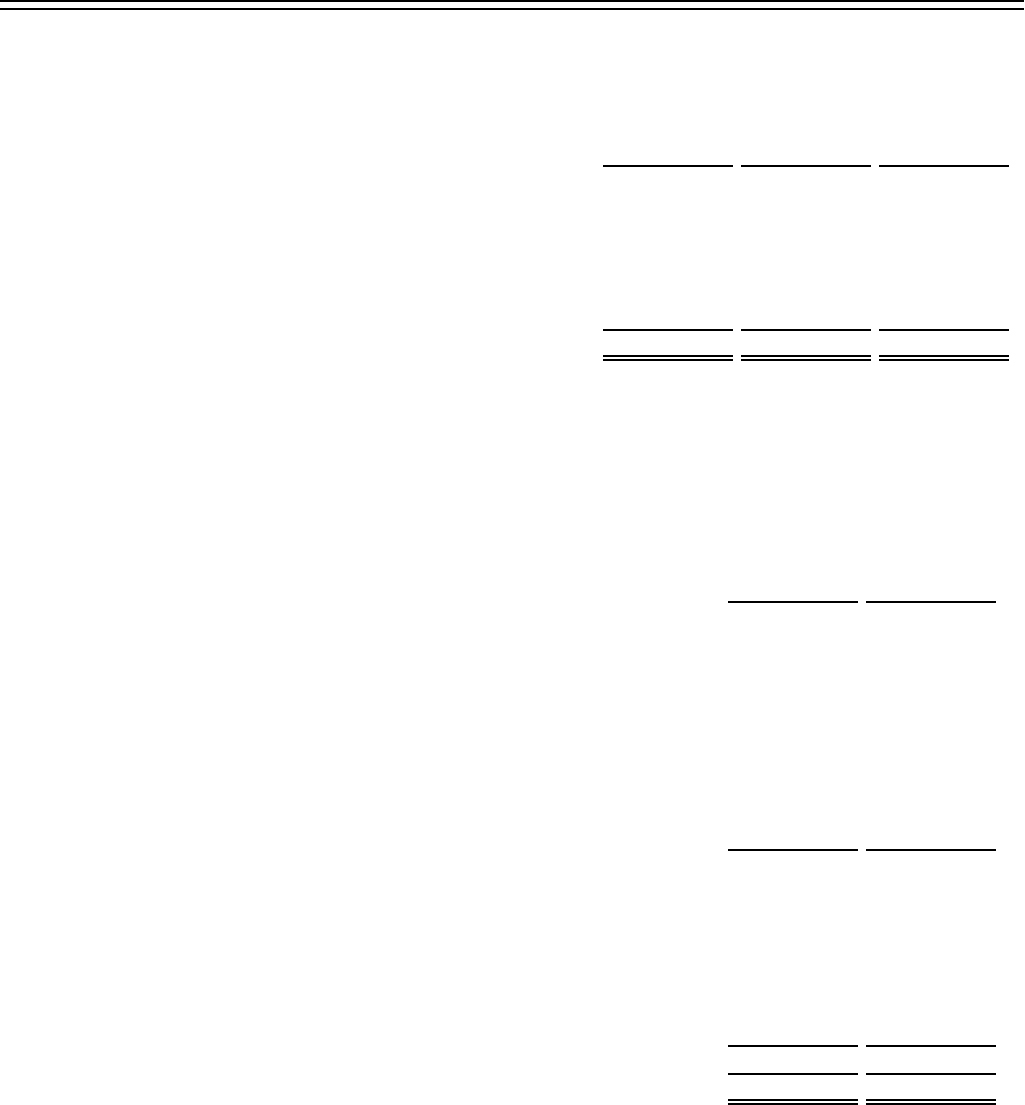

The income tax expense reported differs from the expected tax computed by applying the federal income tax

statutory rate of 35% for 2014, 2013 and 2012 to income before income taxes. The reasons for this difference and their tax

effects are as follows:

2014 2013 2012

(millions)

Expected tax............................................................................................. $ 836 $ 801 $ 736

State and local income taxes, net of federal income tax benefit .............. 59 45 47

Historic rehabilitation tax credit............................................................... (20)(16) —

Change in valuation allowance ................................................................ 1 (16)(2)

Other......................................................................................................... (12)(10)(14)

$ 864 $ 804 $ 767

The Company participates in the Internal Revenue Service (“IRS”) Compliance Assurance Program ("CAP"). As

part of the CAP, tax years are audited on a contemporaneous basis so that all or most issues are resolved prior to the filing

of the tax return. The IRS has completed examinations of 2013 and all prior tax years.

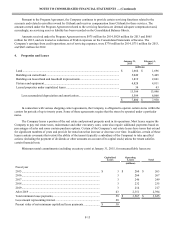

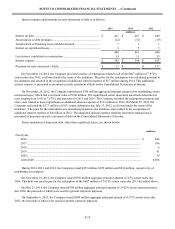

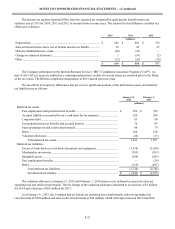

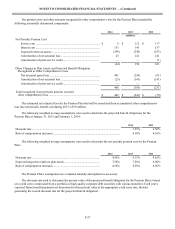

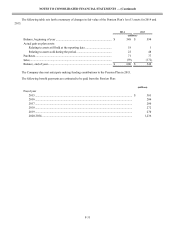

The tax effects of temporary differences that give rise to significant portions of the deferred tax assets and deferred

tax liabilities are as follows:

January 31,

2015 February 1,

2014

(millions)

Deferred tax assets

Post employment and postretirement benefits ......................................................... $ 586 $ 392

Accrued liabilities accounted for on a cash basis for tax purposes.......................... 320 289

Long-term debt......................................................................................................... 83 90

Unrecognized state tax benefits and accrued interest............................................... 76 84

State operating loss and credit carryforwards .......................................................... 80 79

Other......................................................................................................................... 160 160

Valuation allowance................................................................................................. (24)(23)

Total deferred tax assets.................................................................................... 1,281 1,071

Deferred tax liabilities

Excess of book basis over tax basis of property and equipment.............................. (1,510)(1,569)

Merchandise inventories .......................................................................................... (585)(587)

Intangible assets ....................................................................................................... (294)(263)

Post employment benefits ........................................................................................ — (28)

Other......................................................................................................................... (335)(297)

Total deferred tax liabilities.............................................................................. (2,724)(2,744)

Net deferred tax liability ................................................................................... $ (1,443) $ (1,673)

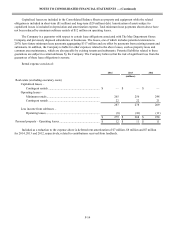

The valuation allowance at January 31, 2015 and February 1, 2014 relates to net deferred tax assets for state net

operating loss and credit carryforwards. The net change in the valuation allowance amounted to an increase of $1 million

for 2014 and a decrease of $16 million for 2013.

As of January 31, 2015, the Company had no federal net operating loss carryforwards, state net operating loss

carryforwards of $595 million and state credit carryforwards of $29 million, which will expire between 2015 and 2034.