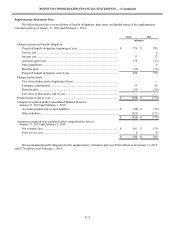

Macy's 2014 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2014 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

F-22

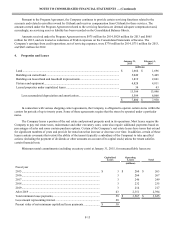

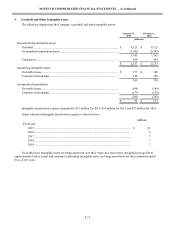

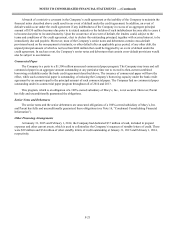

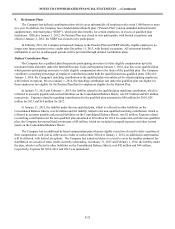

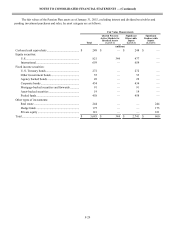

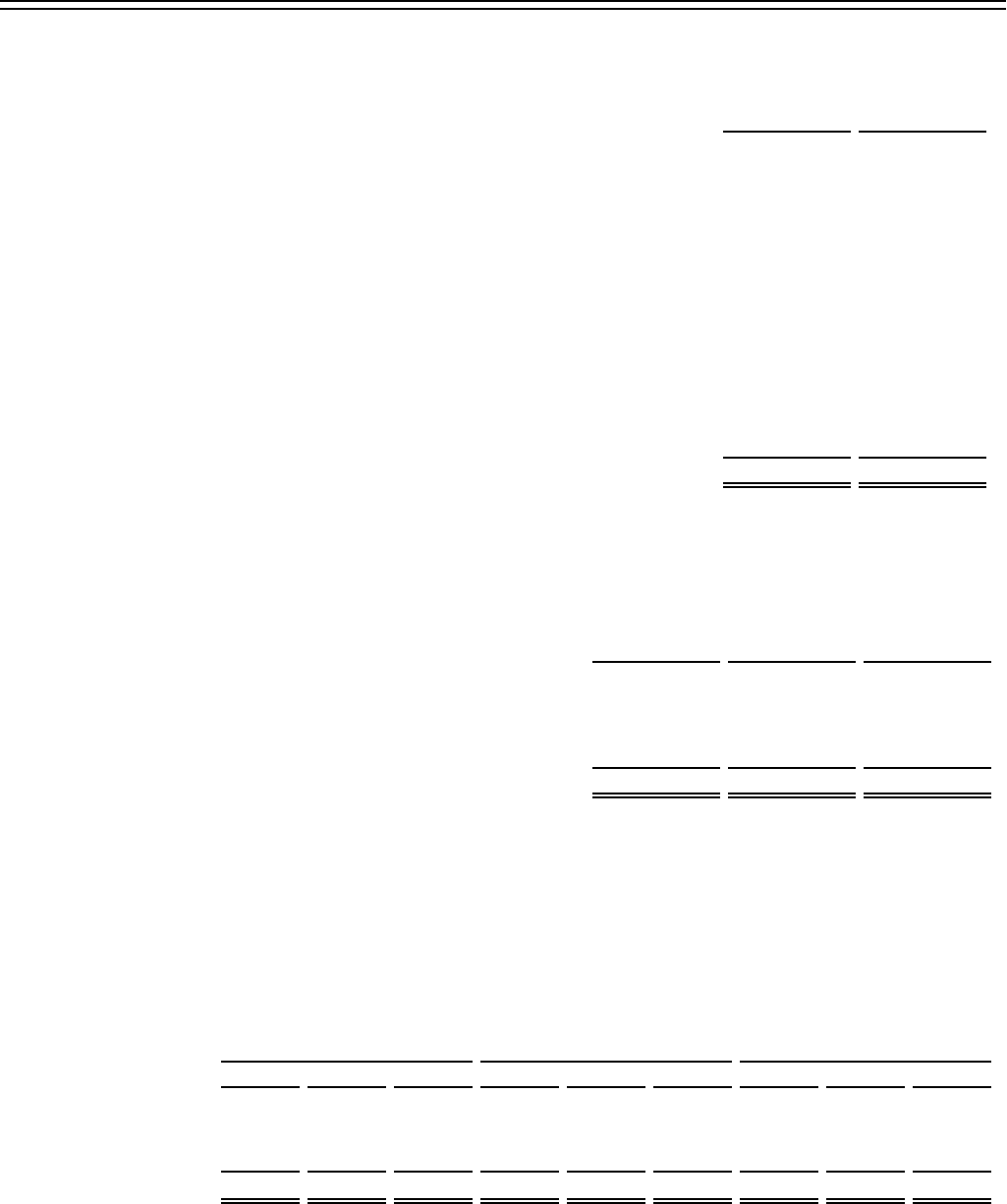

7. Accounts Payable and Accrued Liabilities

January 31,

2015 February 1,

2014

(millions)

Accounts payable................................................................................................................ $ 833 $ 746

Gift cards and customer award certificates......................................................................... 907 840

Accrued wages and vacation .............................................................................................. 193 190

Current portion of post employment and postretirement benefits...................................... 190 110

Taxes other than income taxes............................................................................................ 187 157

Lease related liabilities ....................................................................................................... 155 153

Current portion of workers’ compensation and general liability reserves.......................... 128 131

Accrued interest.................................................................................................................. 93 89

Allowance for future sales returns...................................................................................... 93 85

Severance and relocation.................................................................................................... 46 43

Other ................................................................................................................................... 284 266

$ 3,109 $ 2,810

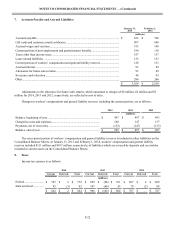

Adjustments to the allowance for future sales returns, which amounted to charges of $8 million, $4 million and $5

million for 2014, 2013 and 2012, respectively, are reflected in cost of sales.

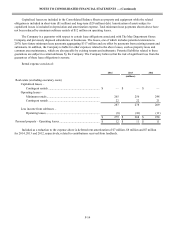

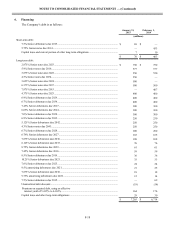

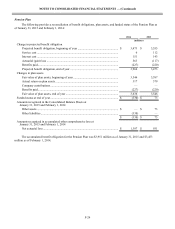

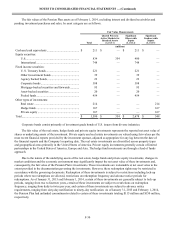

Changes in workers’ compensation and general liability reserves, including the current portion, are as follows:

2014 2013 2012

(millions)

Balance, beginning of year....................................................................... $ 497 $ 497 $ 493

Charged to costs and expenses................................................................. 160 147 157

Payments, net of recoveries...................................................................... (152)(147)(153)

Balance, end of year................................................................................. $ 505 $ 497 $ 497

The non-current portion of workers’ compensation and general liability reserves is included in other liabilities on the

Consolidated Balance Sheets. At January 31, 2015 and February 1, 2014, workers’ compensation and general liability

reserves included $111 million and $107 million, respectively, of liabilities which are covered by deposits and receivables

included in current assets on the Consolidated Balance Sheets.

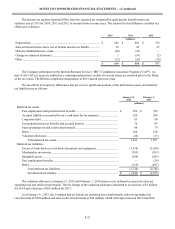

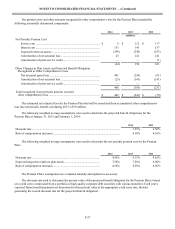

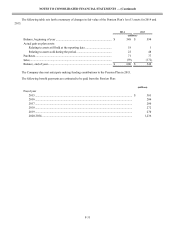

8. Taxes

Income tax expense is as follows:

2014 2013 2012

Current Deferred Total Current Deferred Total Current Deferred Total

(millions)

Federal .......................... $ 767 $ 5 $ 772 $ 859 $ (98) $ 761 $ 697 $ 2 $ 699

State and local............... 95 (3) 92 107 (64) 43 70 (2) 68

$ 862 $ 2 $ 864 $ 966 $ (162) $ 804 $ 767 $ — $ 767