Macy's 2014 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2014 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

F-21

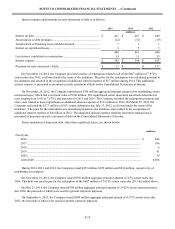

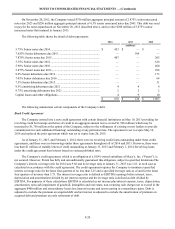

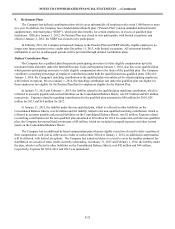

A breach of a restrictive covenant in the Company’s credit agreement or the inability of the Company to maintain the

financial ratios described above could result in an event of default under the credit agreement. In addition, an event of

default would occur under the credit agreement if any indebtedness of the Company in excess of an aggregate principal

amount of $150 million becomes due prior to its stated maturity or the holders of such indebtedness become able to cause it

to become due prior to its stated maturity. Upon the occurrence of an event of default, the lenders could, subject to the

terms and conditions of the credit agreement, elect to declare the outstanding principal, together with accrued interest, to be

immediately due and payable. Moreover, most of the Company’s senior notes and debentures contain cross-default

provisions based on the non-payment at maturity, or other default after an applicable grace period, of any other debt, the

unpaid principal amount of which is not less than $100 million that could be triggered by an event of default under the

credit agreement. In such an event, the Company’s senior notes and debentures that contain cross-default provisions would

also be subject to acceleration.

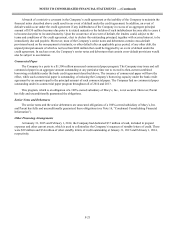

Commercial Paper

The Company is a party to a $1,500 million unsecured commercial paper program. The Company may issue and sell

commercial paper in an aggregate amount outstanding at any particular time not to exceed its then-current combined

borrowing availability under the bank credit agreement described above. The issuance of commercial paper will have the

effect, while such commercial paper is outstanding, of reducing the Company’s borrowing capacity under the bank credit

agreement by an amount equal to the principal amount of such commercial paper. The Company had no commercial paper

outstanding under its commercial paper program throughout all of 2014 and 2013.

This program, which is an obligation of a 100%-owned subsidiary of Macy’s, Inc., is not secured. However, Parent

has fully and unconditionally guaranteed the obligations.

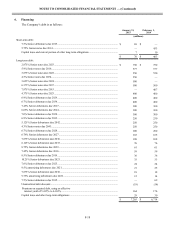

Senior Notes and Debentures

The senior notes and the senior debentures are unsecured obligations of a 100%-owned subsidiary of Macy’s, Inc.

and Parent has fully and unconditionally guaranteed these obligations (see Note 16, “Condensed Consolidating Financial

Information”).

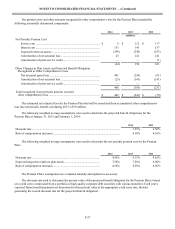

Other Financing Arrangements

At January 31, 2015 and February 1, 2014, the Company had dedicated $37 million of cash, included in prepaid

expenses and other current assets, which is used to collateralize the Company’s issuances of standby letters of credit. There

were $29 million and $34 million of other standby letters of credit outstanding at January 31, 2015 and February 1, 2014,

respectively.