Macy's 2014 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2014 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

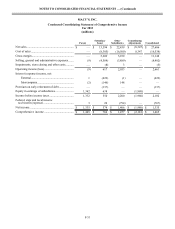

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

F-41

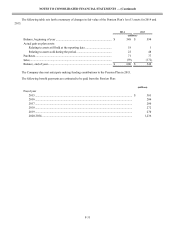

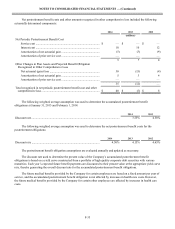

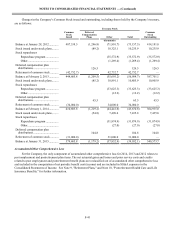

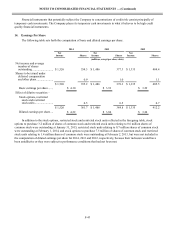

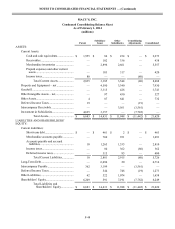

Changes in the Company’s Common Stock issued and outstanding, including shares held by the Company’s treasury,

are as follows:

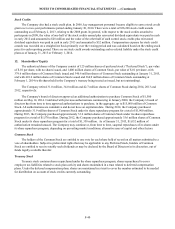

Treasury Stock

Common

Stock

Issued

Deferred

Compensation

Plans Other Total

Common

Stock

Outstanding

(thousands)

Balance at January 28, 2012............. 487,338.5 (1,246.8)(71,910.7)(73,157.5) 414,181.0

Stock issued under stock plans......... (89.2) 10,325.1 10,235.9 10,235.9

Stock repurchases

Repurchase program ................. (35,572.9)(35,572.9)(35,572.9)

Other.......................................... (1,269.4)(1,269.4)(1,269.4)

Deferred compensation plan

distributions .................................. 126.5 126.5 126.5

Retirement of common stock ........... (42,732.7) 42,732.7 42,732.7 —

Balance at February 2, 2013............. 444,605.8 (1,209.5)(55,695.2)(56,904.7) 387,701.1

Stock issued under stock plans......... (85.2) 10,891.1 10,805.9 10,805.9

Stock repurchases

Repurchase program ................. (33,625.3)(33,625.3)(33,625.3)

Other.......................................... (12.2)(12.2)(12.2)

Deferred compensation plan

distributions .................................. 65.5 65.5 65.5

Retirement of common stock ........... (34,000.0) 34,000.0 34,000.0 —

Balance at February 1, 2014............. 410,605.8 (1,229.2)(44,441.6)(45,670.8) 364,935.0

Stock issued under stock plans......... (54.8) 7,490.6 7,435.8 7,435.8

Stock repurchases

Repurchase program ................. (31,874.9)(31,874.9)(31,874.9)

Other.......................................... (27.0)(27.0)(27.0)

Deferred compensation plan

distributions .................................. 104.8 104.8 104.8

Retirement of common stock ........... (31,000.0) 31,000.0 31,000.0 —

Balance at January 31, 2015............. 379,605.8 (1,179.2)(37,852.9)(39,032.1) 340,573.7

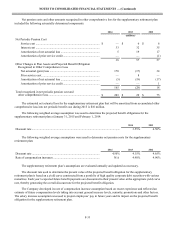

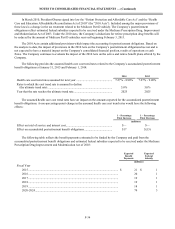

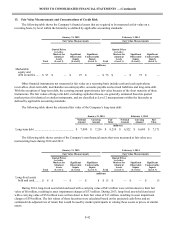

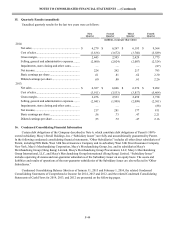

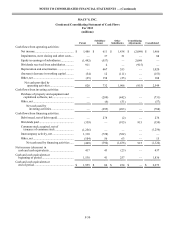

Accumulated Other Comprehensive Loss

For the Company, the only component of accumulated other comprehensive loss for 2014, 2013 and 2012 relates to

post employment and postretirement plan items. The net actuarial gains and losses and prior service costs and credits

related to post employment and postretirement benefit plans are reclassified out of accumulated other comprehensive loss

and included in the computation of net periodic benefit cost (income) and are included in SG&A expenses in the

Consolidated Statements of Income. See Note 9, "Retirement Plans," and Note 10, "Postretirement Health Care and Life

Insurance Benefits," for further information.