Macy's 2014 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2014 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

20

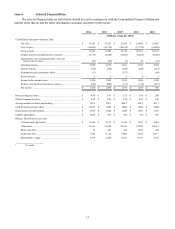

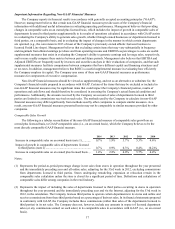

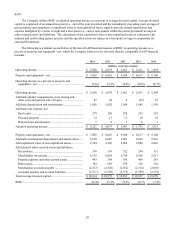

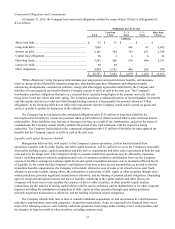

ROIC

The Company defines ROIC as adjusted operating income as a percent to average invested capital. Average invested

capital is comprised of an annual two-point (i.e., end of the year presented and the immediately preceding year) average of

gross property and equipment, a capitalized value of non-capitalized leases equal to periodic annual reported net rent

expense multiplied by a factor of eight and a four-point (i.e., end of each quarter within the period presented) average of

other selected assets and liabilities. The calculation of the capitalized value of non-capitalized leases is consistent with

industry and credit rating agency practice and the specified assets are subject to a four-point average to compensate for

seasonal fluctuations.

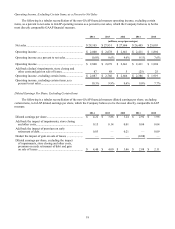

The following is a tabular reconciliation of the non-GAAP financial measure of ROIC to operating income as a

percent to property and equipment - net, which the Company believes to be the most directly comparable GAAP financial

measure.

2014 2013 2012 2011 2010

(millions, except percentages)

Operating income .............................................................. $ 2,800 $ 2,678 $ 2,661 $ 2,411 $ 1,894

Property and equipment - net ............................................ $ 7,865 $ 8,063 $ 8,308 $ 8,617 $ 9,160

Operating income as a percent to property and

equipment - net .............................................................. 35.6% 33.2% 32.0% 28.0% 20.7%

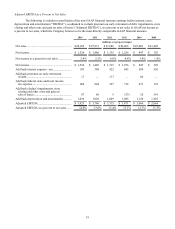

Operating income .............................................................. $ 2,800 $ 2,678 $ 2,661 $ 2,411 $ 1,894

Add back (deduct) impairments, store closing and

other costs and gain on sale of leases............................. 87 88 5 (25) 25

Add back depreciation and amortization........................... 1,036 1,020 1,049 1,085 1,150

Add back rent expense, net

Real estate...................................................................... 279 268 258 243 235

Personal property ........................................................... 12 11 11 10 10

Deferred rent amortization............................................. 78787

Adjusted operating income................................................ $ 4,221 $ 4,073 $ 3,991 $ 3,732 $ 3,321

Property and equipment - net ............................................ $ 7,865 $ 8,063 $ 8,308 $ 8,617 $ 9,160

Add back accumulated depreciation and amortization...... 5,830 6,007 5,967 6,018 5,916

Add capitalized value of non-capitalized leases................ 2,384 2,296 2,208 2,088 2,016

Add (deduct) other selected assets and liabilities:

Receivables .................................................................... 336 339 322 294 317

Merchandise inventories................................................ 6,155 6,065 5,754 5,596 5,211

Prepaid expenses and other current assets ..................... 443 398 390 409 283

Other assets.................................................................... 784 659 579 528 526

Merchandise accounts payable ...................................... (2,472)(2,520)(2,362)(2,314)(2,085)

Accounts payable and accrued liabilities....................... (2,511)(2,328)(2,333)(2,309)(2,274)

Total average invested capital............................................ $ 18,814 $ 18,979 $ 18,833 $ 18,927 $ 19,070

ROIC.................................................................................. 22.4% 21.5% 21.2% 19.7% 17.4%