Lumber Liquidators 2015 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2015 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Lumber Liquidators Holdings, Inc.

Notes to Consolidated Financial Statements

(amounts in thousands, except share data and per share amounts)

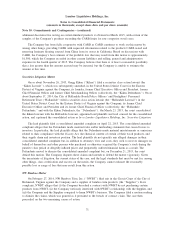

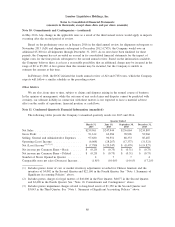

Note 11. Condensed Quarterly Financial Information (unaudited) − (continued)

Quarter Ended

March 31,

2014

June 30,

2014

September 30,

2014

December 31,

2014

Net Sales ........................... $246,291 $263,085 $266,067 $271,976

Gross Profit ......................... 101,287 106,238 104,158 106,484

Selling, General and Administrative Expenses . . 78,866 79,066 78,377 77,805

Operating (Loss) Income ................ 22,421 27,172 25,781 28,679

Net (Loss) Income ..................... $ 13,694 $ 16,607 $ 15,725 $ 17,345

Net income per Common Share − Basic ...... $ 0.50 $ 0.61 $ 0.58 $ 0.64

Net income per Common Share − Diluted ..... $ 0.49 $ 0.60 $ 0.58 $ 0.64

Number of Stores Opened in Quarter ........ 13 13 5 3

Comparable store net sales (Decrease) Increase . . (0.6)% (7.1)% (4.9)% (4.2)%

Note 12. Subsequent Events

In February 2016, the Company paid settlement amounts totaling $6,200, as described in Note 10, under

Lacey Act Related Matters.

Due to a planned build in inventory, the Company borrowed an additional $10,000 under its Revolving

Credit Facility, as described in Note 4. As of February 29, 2016, the Company has $30,000 in outstanding

borrowings under the Revolving Credit Facility.

81