Lumber Liquidators 2015 Annual Report Download - page 45

Download and view the complete annual report

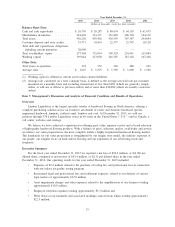

Please find page 45 of the 2015 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.levels as a percentage of our sales mix. Laminates represented approximately 15.7% of our sales in 2015

compared to 19.1% and 19.6% in 2014 and 2013, respectively.

Consumer Product Safety Commission Investigation

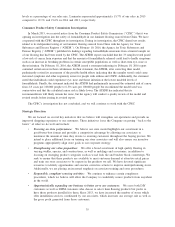

In March 2015, we received notice from the Consumer Product Safety Commission (‘‘CPSC’’) that it was

opening an investigation into the safety of formaldehyde in our laminate flooring sourced from China. We have

cooperated with the CPSC throughout its investigation. During its investigation, the CPSC shared test results

related to its independent testing of our laminate flooring sourced from China with the Agency for Toxic

Substances and Disease Registry (‘‘ATSDR’’). On February 10, 2016, the Agency for Toxic Substances and

Disease Registry (‘‘ATSDR’’) published its findings regarding formaldehyde emissions from a limited sample set

of our flooring that had been tested by the CPSC. The ATSDR report concluded that the 33 samples tested posed

a low risk of cancer from exposure and that the amount of formaldehyde released could lead to health symptoms

such as an increase in breathing problems in certain susceptible populations as well as short-term eye, nose or

throat irritation. On February 18, 2016, the ATSDR issued a statement indicating its February 10, 2016 report

contained certain errors in their calculations. In their statement, the ATSDR, after correcting their model,

preliminarily revised its assessment of the possible health effects indicating that the samples tested could cause

increased symptoms and other respiratory issues for people with asthma and COPD. Additionally, the statement

noted that individuals could experience eye, nose and throat irritation at the lowest modeled levels of

formaldehyde. Finally, the statement indicated the ATSDR had preliminarily increased the estimated risk of cancer

from 2-9 cases per 100,000 people to 6-30 cases per 100,000 people but reconfirmed the model used was

conservative and that the calculated cancer risk is likely lower. The ATSDR has indicated that its

recommendations will likely remain the same, but the agency will conduct a quality review of the model and

revised results before issuing its revised report.

The CPSC’s investigation has not concluded, and we will continue to work with the CPSC.

Strategic Direction

We are focused on several key initiatives that we believe will strengthen our operations and provide an

improved shopping experience to our customers. These initiatives focus the Company on getting ‘‘back to the

basics’’ of what we do well and include:

•Focusing on store performance: We believe our store model highlights our assortment in a

good-better-best format and provides a competitive advantage by allowing our associates to

maximize the amount of time they devote to assisting customers throughout the buying process. We

intend to place additional focus on training our store associates and will also ensure our incentive

programs appropriately align store goals to our corporate strategy.

•Strengthening our value proposition: We offer a broad assortment of high quality flooring in

varying widths, species, and constructions, as well as moldings and accessories, in addition to

focusing on emerging product categories such as wood look tile and butcher block countertops. We

seek to ensure that these products are available to meet customer demand at attractive retail prices

and train our store associates to be experts in the products we sell. We have devoted significant

resources to identify opportunities and execute corrective actions to improve underperforming stores.

Additionally, we are placing an increased emphasis on associate training and store procedures.

•Responsible, compliant sourcing activities: We continue to enhance certain compliance

procedures, which we believe will allow the Company to confidently source products from anywhere

in the world.

•Opportunistically expanding our business to better serve our customers: We serve both DIY

customers as well as DIFM customers who choose to select their flooring products but prefer to

have those products installed for them. Since 2013, we have increased the number of stores which

offer installation services coordinated by our associates, which increases our average sale as well as

the gross profit generated from those customers.

35