Lumber Liquidators 2015 Annual Report Download - page 44

Download and view the complete annual report

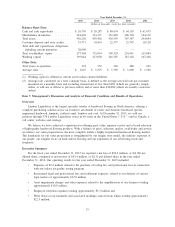

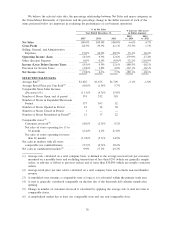

Please find page 44 of the 2015 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Our net sales for the year ended December 31, 2015 were $978.8 million, a decrease of $68.6 million

from the $1.05 billion recorded during the year ended December 31, 2014. Our comparable store sales

decreased 11.1%, driven by a 8.0% decrease in the number of customers invoiced and a 3.1% decrease in our

average sale.

We believe our net sales were negatively impacted by certain unfavorable allegations made surrounding

the product quality, and subsequent suspension, of our laminates sourced from China. The allegations were

part of a 60 Minutes episode that originally aired on March 1, 2015 (‘‘the Broadcast’’). During 2015, we

responded to the impact of these allegations on our sales by focusing our efforts on getting back to basics,

taking care of our customers, and executing on our value proposition. As a result of these efforts, we

accomplished the following:

• Reduced our inventory levels and improved the quality of our on hand inventory while conserving

cash flow,

• Simplified our product assortment by eliminating approximately 140 flooring varieties and related

moldings, which were identified as duplicative, discontinued or less popular products, to improve the

customer shopping experience,

• Returned to the core of our business by ending planned vertical integration initiatives and tile

expansions,

• Improved our vendor relationships across the globe, and

• Distributed over 48,000 free indoor air quality screening kits as part of our voluntary commitment to

help our customers better understand the air quality in their homes. Refer to Other Matters for

further discussion of the indoor air quality testing program.

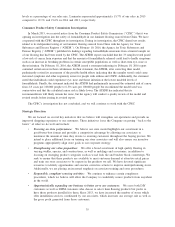

Settlement of the Lacey Act Investigation

Additionally, in conjunction with the Special Committee of the Board of Directors (the ‘‘Special

Committee’’), we continue to address various legal matters and regulatory matters facing the Company. As

previously disclosed, during the fourth quarter of 2015, we entered into a settlement with the DOJ related to

our compliance with the Lacey Act. The settlement requires the Company to implement an Environmental

Compliance Program (the ‘‘Compliance Plan’’) and pay certain fines and forfeit assets totaling approximately

$13.2 million. Based on our current expectations, we anticipate implementation and ongoing compliance costs

of these enhancements to cost up to $3.5 million through 2016, of which approximately $0.5 million was

incurred in the fourth quarter of 2015. We believe the ongoing costs of our compliance program will be higher

than historical levels as we implement the Compliance Plan, however, the scope of those costs will be

determined by future sourcing initiatives and other factors. Refer to Part I, Item 3. — Legal Proceedings for a

complete description of legal and regulatory issues facing the Company.

Update on Laminate Flooring Sourced from China

On May 7, 2015, we suspended the sale of our laminate products sourced from China pending further

assessment of the situation. As a part of our assessment, we considered expectations regarding customer

sentiment, market conditions, findings by regulatory agencies, legal proceedings, channels for disposition and

other factors. During the quarter ended December 31, 2015, we determined that we would not sell our current

inventory of laminate flooring sourced from China in our stores as a result of strategic and operational

considerations including the potential distraction these products could have on our employees and our

business. As a result of this decision, we reduced the carrying value of this laminate flooring and related

moldings to its net realizable value of zero, resulting in a charge of approximately $22.5 million to cost of

sales. We expect to incur certain costs in the first half of 2016 related to the consolidation of this laminate

inventory to a central warehouse of between $1.0 million and $3.0 million. We may also incur additional costs

in future periods related to the ultimate disposition of this product.

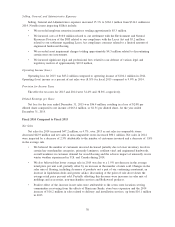

In order to meet customer demand, we shifted the sourcing of laminate products previously manufactured

in China to suppliers located in Europe and North America. We believe our laminate assortment has been

received positively by our customers and further believe the sales of such products will approach historical

34